Box Turtle Bulletin

News and commentary about the anti-gay lobby

News and commentary about the anti-gay lobby News and commentary about the anti-gay lobby

News and commentary about the anti-gay lobbyApril 16th, 2012

Marie Antoinette got a bad rap.

Marie Antoinette got a bad rap.

As the lore goes, she was told about the plight of the French people who were suffering during a famine. And upon learning that there was a shortage of bread, a staple of the diet, she said, “Qu’ils mangent de la brioche”. And since that day, the term “let them eat cake” has been a symbol of the callousness or obliviousness of the wealthy elite.

Actually, she probably never said it. A story written when she was a child (living in Austria) was combined with anti-royalist sentiments and, as is often the case in politics, actual truth was far less interesting than a story too good not to repeat. The real Marie was less villainous than the cartoon characterization and was reportedly concerned about the plight of the people and generous with charity. Had she also not been even more generous with herself while France was in financial disarray (or had royalists quelled the revolution) history would be kinder.

But whichever noblewoman (real or fictional) uttered the phrase, they don’t deserve to be the symbol of callousness.

The response reflects on a character so self-absorbed that it isn’t aware of the plight of others and so oblivious of the lives outside their experience that they make absurd assumptions. But at least she offered a solution. An ignorant foolish solution perhaps, but one that hints that she cared at least some little bit about their plight.

Which is more than I can say about some today in the anti-gay movement.

I don’t think we need to reiterate here that there is an epidemic of bullying in schools across the nation. At this point, it is not speculative or alleged or partisan. On this, voices as diverse as Lady Gaga and Mike Huckabee can agree.

And it is simply irrefutable that gay students are more likely to be a target than are most students. And after several kids who identified as gay (or were assumed to be) took their own lives, our community coalesced around a serious effort to reduce the terrorism that gay kids experience. One of the efforts implemented is to encourage schools to establish anti-bullying programs that specifically address anti-gay bullying. And related to that is an annual Day of Silence to bring attention to the problem and the encourage students and staff to take this problem seriously.

But solutions are not easy or obvious. Even schools that have implemented anti-bullying programs still experience levels of bullying that would have been considered unacceptable a decade ago. And people of good intention may differ on the response.

Some religious conservatives also have been worried that in their advocacy for gay kids, schools might not fully consider the consequences of some messages. Many people of faith have restrictions on sexual behavior as part of their moral code and teach their children certain rules about sex outside of marriage. Sometimes those outside the faith do not understand the nuance of such teachings. And should a public school misrepresented such teachings or declared them “harmful” and those who followed such rules as “bigots”, it could make targets out of religious kids.

Replacing gay kids as a target for scorn and humiliation with Christian kids doesn’t solve the problem, and it is valid to raise that point. And, indeed, some school districts listened to those views and were able to bring in gay people and pastors and people of diverse communities to make sure that the programs addressed everyone’s concerns and were supported by the full community. This is an area about which there should be no disagreement and, when all parties want to work together consensus is possible.

Alternately, some chose to respond directly by participating in a Golden Rule Pledge. Rather than discuss the possible implications, they sought to offset any possible negative views of Christian kids by visibly breaking the association with bigotry. By having religious kids say, “Yes, we agree, no one should be bullied and we promise to stand with you and protect you”, Christian kids could oppose the harm without having to defend their own values.

But there were those among conservative Christianity who had a less generous response. For example, Dr. Michael Brown writes today about the Day of Silence in a way that makes it clear that kids bullied to death are the least of his concerns.

But there were those among conservative Christianity who had a less generous response. For example, Dr. Michael Brown writes today about the Day of Silence in a way that makes it clear that kids bullied to death are the least of his concerns.

Brown sets the tone by starting with dishonesty:

On April 20th, in thousands of schools across America, your hard-earned tax dollars will help underwrite the homosexual indoctrination of your kids.

Setting aside the absurd notion that protecting children from bullying is the same as “homosexual indoctrination of your kids”, the Day of Silence is not funded by tax dollars. It doesn’t really cost much of anything for students to be silent for the day and the direct costs of posters and other publicity are not paid by the schools. I suppose that one could argue that anything that occurs on a school grounds is “underwritten” by “your hard-earned tax dollars”, but by that logic it would be much more truthful to say, “your hard-earned tax dollars help underwrite the abuse of gay kids today”.

Dr. Brown is a careful writer. He usually avoids sentences or short passages that can be extracted from his writing to illustrate his animosity. He doesn’t use words like “pervert” or “abomination”. He works with innuendo and insinuation and plays on the existing biases of his target audience. Consider:

But don’t some schools already have generic, anti-bullying programs in place along with special, daylong events to highlight the destructive effects of bullying, a subject that should concern all of us? Of course they do, but that’s not enough. GLSEN insists that a special focus must be put on LGBT kids, as if bullying a gay kid was worse than bullying a fat kid.

It’s clever. In one sentence absent of any slurs he manages to insinuate that gay people are demanding special consideration, that any attention given to gay bullying takes away from other targets of bullying, and that gay activists are unfairly demanding resources that aren’t needed.

Of course, that isn’t close to true. As the epidemic of bullying illustrates, most schools have, at best, a perfunctory anti-bullying program (that isn’t implemented with seriousness) coupled with a devoted commitment to denial. The movie Bully provides an illustration of a child being tormented daily on a school bus while administrators assured the documentarian that the other children were “good as gold”.

And as any gay kid – and most fat kids – will tell you, bullying of gay kids really is worse. Fat kids have families to turn to while gay kids often do not have that option. And on most campuses there is an agreement that calling a fat kid names is “a bad thing to do” while many children attending churches of which Dr. Brown would approve do not share the belief that saying “you’re an abomination and going to hell” to gay kids is “a bad thing to do”.

But that isn’t really the most telling point about that paragraph. I’ll come back to that.

He goes on with artificial concern about ex-gays being excluded from the Day of Silence (as though there has ever been a single kid to identify as ex-gay who was in any way excluded from this student organized event). He rants about a nameless black teacher who “did not approve of equating gay activism with the civil rights movement.” He makes the usual intentionally dishonest false equation in which the balance to “don’t bully gay kids” is “a religious or moral objection to homosexuality”.

But all of that is just filler and fluff; it’s what he didn’t say that is worth noting. At no point in his 869 word essay did Dr. Brown ever express the slightest concern about the plight of tormented gay kids or provide any alternate solution. His position – that which is opposite of GLSEN’s position, can be seen in the paragraph we noted above.

Of course they do, but that’s not enough.

Dr. Brown and GLSEN are both aware of the high rate of gay teen suicides. Dr. Brown and GLSEN are well aware that openly gay teens – and even those suspected of being gay – are tormented at rates far higher than any demographic. Including the “fat kid” demographic. GLSEN believes that the current status is “not enough” and Dr. Brown disagrees.

Now Dr. Brown would never use the words. He would never say them out loud. And he’ll likely send me an email telling me that I’m misrepresenting his position and putting words in his mouth. But the message is clear.

When told that due to the famine the peasants had no bread, Marie Antoinette’s solution was, “let them eat cake”. When told that gay students are being bullied to the point that they kill themselves, Dr. Michael Brown’s answer is, “let them die.”

Marie Antoinette got a bad rap.

Latest Posts

Featured Reports

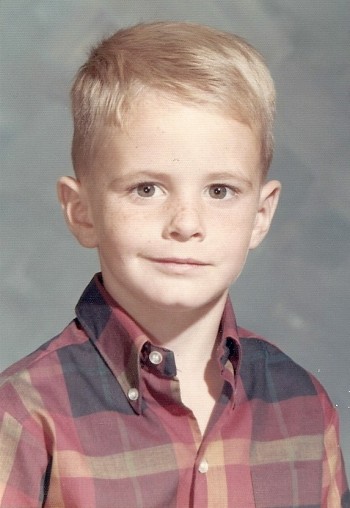

In this original BTB Investigation, we unveil the tragic story of Kirk Murphy, a four-year-old boy who was treated for “cross-gender disturbance” in 1970 by a young grad student by the name of George Rekers. This story is a stark reminder that there are severe and damaging consequences when therapists try to ensure that boys will be boys.

In this original BTB Investigation, we unveil the tragic story of Kirk Murphy, a four-year-old boy who was treated for “cross-gender disturbance” in 1970 by a young grad student by the name of George Rekers. This story is a stark reminder that there are severe and damaging consequences when therapists try to ensure that boys will be boys.

When we first reported on three American anti-gay activists traveling to Kampala for a three-day conference, we had no idea that it would be the first report of a long string of events leading to a proposal to institute the death penalty for LGBT people. But that is exactly what happened. In this report, we review our collection of more than 500 posts to tell the story of one nation’s embrace of hatred toward gay people. This report will be updated continuously as events continue to unfold. Check here for the latest updates.

In 2005, the Southern Poverty Law Center wrote that “[Paul] Cameron’s ‘science’ echoes Nazi Germany.” What the SPLC didn”t know was Cameron doesn’t just “echo” Nazi Germany. He quoted extensively from one of the Final Solution’s architects. This puts his fascination with quarantines, mandatory tattoos, and extermination being a “plausible idea” in a whole new and deeply disturbing light.

On February 10, I attended an all-day “Love Won Out” ex-gay conference in Phoenix, put on by Focus on the Family and Exodus International. In this series of reports, I talk about what I learned there: the people who go to these conferences, the things that they hear, and what this all means for them, their families and for the rest of us.

Prologue: Why I Went To “Love Won Out”

Part 1: What’s Love Got To Do With It?

Part 2: Parents Struggle With “No Exceptions”

Part 3: A Whole New Dialect

Part 4: It Depends On How The Meaning of the Word "Change" Changes

Part 5: A Candid Explanation For "Change"

At last, the truth can now be told.

At last, the truth can now be told.

Using the same research methods employed by most anti-gay political pressure groups, we examine the statistics and the case studies that dispel many of the myths about heterosexuality. Download your copy today!

And don‘t miss our companion report, How To Write An Anti-Gay Tract In Fifteen Easy Steps.

Anti-gay activists often charge that gay men and women pose a threat to children. In this report, we explore the supposed connection between homosexuality and child sexual abuse, the conclusions reached by the most knowledgeable professionals in the field, and how anti-gay activists continue to ignore their findings. This has tremendous consequences, not just for gay men and women, but more importantly for the safety of all our children.

Anti-gay activists often charge that gay men and women pose a threat to children. In this report, we explore the supposed connection between homosexuality and child sexual abuse, the conclusions reached by the most knowledgeable professionals in the field, and how anti-gay activists continue to ignore their findings. This has tremendous consequences, not just for gay men and women, but more importantly for the safety of all our children.

Anti-gay activists often cite the “Dutch Study” to claim that gay unions last only about 1½ years and that the these men have an average of eight additional partners per year outside of their steady relationship. In this report, we will take you step by step into the study to see whether the claims are true.

Tony Perkins’ Family Research Council submitted an Amicus Brief to the Maryland Court of Appeals as that court prepared to consider the issue of gay marriage. We examine just one small section of that brief to reveal the junk science and fraudulent claims of the Family “Research” Council.

The FBI’s annual Hate Crime Statistics aren’t as complete as they ought to be, and their report for 2004 was no exception. In fact, their most recent report has quite a few glaring holes. Holes big enough for Daniel Fetty to fall through.

The FBI’s annual Hate Crime Statistics aren’t as complete as they ought to be, and their report for 2004 was no exception. In fact, their most recent report has quite a few glaring holes. Holes big enough for Daniel Fetty to fall through.

Muscat

April 16th, 2012

IME fat boys are commonly taunted as “f—-t” while fat girls are commonly taunted as “d–e.”

andrewdb

April 16th, 2012

I think it is important that we continue to emphasize these anti-bullying programs are about *perceived* gay kids – they also protect the straight kids who don’t fit in.

Nick Thiwerspoon

April 16th, 2012

The Christianists at it again. Thin-lipped, judgemental, dishonest, cruel, heartless, evil.

“Love one another as I loved you”

Yeah, right.

Fritz Keppler

April 17th, 2012

Love is the most deceitful mask that hate wears, isn’t it.

chanson

April 17th, 2012

I don’t think it’s a helpful strategy to turn this into a debate over who gets it the worst.

“And as any gay kid – and most fat kids – will tell you, bullying of gay kids really is worse.” Really? That’s not necessarily true, and your claim is unnecessarily divisive. Both bullying of fat kids and bullying of gay kids can be devastating, and both should be stopped. Yes, sometimes a fat kid gets love and support from home that a gay kid doesn’t get, yet OTOH sometimes a gay kid gets love and support at home, and sometimes a fat kid gets shamed by his parents as bad or worse than he gets it at school.

As a parent who is passionate about seeing an end to bullying, I think that focusing on how non-gay-related bullying is (comparatively) no big deal is absolutely a step in the wrong direction. Not to mention that it undercuts your point about feeling concern for the plight of other people who are unlike yourself.

Timothy Kincaid

April 17th, 2012

As a parent who is passionate about seeing an end to bullying, I think that focusing on how non-gay-related bullying is (comparatively) no big deal is absolutely a step in the wrong direction.

True. And, Chanson, if you got the impression that I think bullying a fat kid is no big deal, I apologize. That was not my intent.

But currently anti-gay bullying is a crisis. And it truly does need to be addressed specifically.

When the basement is flooded, it doesn’t mean termites are no big deal. But it does mean that the rising water should get some immediate attention.

Priya Lynn

April 17th, 2012

Chanson no one said non-gay related bullyi8ng is no big deal. Of course some fat kids may get bullied worse than some gay kids but on the whole gay kids as a group get it much worse than fat kids. The point of that is not that we shouldn’t worry about fat kids being bullied it is the idea that bullying of gay kids does not merit priority is a false one.

Blake

April 17th, 2012

You’re right, Blankenhorn seems principled by comparison.

Regardless, Dr. Brown probably doesn’t believe in gay kids. My assumption is that he only believes there are kids who are tempted by evil weak homosexuals to give in to their devilish desires. Hence the bit about “indoctrination”

So many layers of callous!! Personally I blame what I think is his worldview: dualism carried to an absurd extreme. But we could go pop psychology & say he’s having a reaction formation. Whatever lifts your luggage.

@chanson: the big difference between gay and fat is that fat kids don’t get kicked out of their house after their parents notice they’re fat. Check the numbers on homeless gay youths before you start parroting the religious right’s false indignation.

Reed

April 17th, 2012

I had the displeasure of corresponding with Ol’ Doc Brown after his self-published dreck-tome “A Queer Thing Happened to America” issued forth last year in a gush of self-promotion and calls for reviews from his loyal readers.

He is absolutely “convicted” of his rightness, parroting Scott (“gay Nazis”)Lively’s disinformation and citing decades of discredited Cameron-sourced propaganda.

He is the closest thing to evil I’ve yet encountered.

Carlo

April 17th, 2012

I’m sorry, but I haven’t seen much data to support christian children being bullied to epidemic proportions. That is an argument completely made up by the religious right. While I get the need to attempt to be amendable or understanding of those with differing views, including the religious, I think we should stick to facts supported by actual data.

Grand Stacey

April 17th, 2012

It seems to me that an opportunity was missed in this article. As noted, Marie Antionette was concerned with the plight of the people At the time it was customary for the aristicracy to have the crusts cut off their bread. The cut off crusts and trimmings were known by the same French word as cake. When advised that the people were starving, she directed her staff to let them eat the crusts and trimmings, the “cake” to asuage their immediate hunger. Through the years history has focused on the confectionary meaning of “cake” while the other has been lost to antiquity so it is not even considered any more. It is a case of selected interpretatiion, much like those who choose to equate the sin of Sodom to alleged homosexual sex, when in actuality the sin that angered God was in not being hospitable to the strangers in their midst:

Ezekiel 16:49, 49-50 “‘The sin of your sister Sodom was this: She lived with her daughters in the lap of luxury—proud, gluttonous, and lazy. They ignored the oppressed and the poor. They put on airs and lived obscene lives. And you know what happened: I did away with them.

Mudduck

April 17th, 2012

Off topic, but the reference to “hard-earned tax dollars” is a common right-wing ploy, always implying that you industrious citizens are supporting a bunch of lazy bums (probably illegal or non-white). They don’t mention all the really undesirable things our tax dollars DO support, but Doug Blanchard, on his Website “Counterlight’s Peculiars,” fills in that blank this morning: “It’s tax day. Time to pay up for all of those prison contractors; for those government contractors who make the Freedom Bombs and the drones and planes to drop them. Time to fork it over for all of those government subsidies to the oil industry and to Wall Street, for all of those tax breaks for the wealthiest. Time to pay for barbed wire and for all of those canisters of pepper spray and tear gas. Time to pay for tasers and handcuffs and security cameras.” Right-wing outrage is so selective.

Timothy Kincaid

April 17th, 2012

Mudduck,

I’m partly with you.

I find it absurd that oil speculators have tax breaks or that the gov’t bailed out businesses that made billions on nickel and diming the rest of us. And while I do want the Feds to protect us from attack, I do wonder at the monstrous war machine we fund.

I also find it absurd that those who cannot afford to buy a home pay higher taxes so that those whose daddy gave them a down payment can pay a lot less tax. And I marvel that for some reason those who choose to have eight kids are subsidized by those who plan and limit their child bearing.

And why, exactly, should a high school graduate who is out working pay for your upper education? Literally pay, with credits, cash back to you. And you will out earn him for the rest of his life.

So I’m all for rethinking taxes.

But “tax breaks for the wealthiest” is one of those ‘us v. them’ positions that don’t exactly hold up to inspection. “Tax breaks for the poorest” is not a possibility… half of the employed pay no income tax at all. “Tax breaks for the middle class” is a big seller in elections, but the middle class only pay about 20-30% of all taxes.

The wealthiest are the ones who pay most of the taxes. That’s not just a right-wing Limbaugh claim, it’s a fact. That 1% that the occupiers so dislike; they pay between 30 and 40% of all taxes. (and they control about the same percentage of the nation’s wealth).

I suppose ideologically one could believe that they should pay all tax. I have a different philosophy. If you don’t pay for something you have no ownership. Without ownership, you stop caring. (Ask anyone who has lived in a condo building. Owners treat the common area FAR better than do renters.)

I believe that even the very poorest should pay SOME (albeit nominal) tax. It makes them an equal partner. It means they have both the right and obligation to care about the country and are not just residents but citizens.

My solution, a flat tax rate (with one significant drop so that if you make less than, say, $30,000 you only pay 1%). And eliminate ALL loophole, tax incentives, itemized deductions, workers credits, education credits, oil investment credits, benefits for special zones, reductions for children, alternative minimum tax, and everything else.

That way Daddy Warbucks and Joe Sixpack have equal claim. They both pay X% of income (over 30K) to Uncle Sam. It’s fair.

But those who try and sell a flat tax that has the loopholes and exceptions and governmental incentives for their buddies are snake oil salesmen.

Susan Jordan

April 17th, 2012

Like the article and agree. Just want to add though that fat kids don’t always have their parents behind them. My father was a rightwing Republican who was also an extreme emotional abuser. My mom was a narcissist. So the kids at school and my parents both agreed that I was ugly,bad, unlovable etc. Everyone seemed to be in complete agreement about that…

Priya Lynn

April 17th, 2012

Timothy said “That 1% that the occupiers so dislike; they pay between 30 and 40% of all taxes. (and they control about the same percentage of the nation’s wealth).”.

If I remember correctly its more like they control 50% of the nations wealth – they control a higher percentage of the wealth than the percentage of taxes they pay.

Timothy said “I believe that even the very poorest should pay SOME (albeit nominal) tax.”.

Its a myth that the poorest pay no taxes. They pay various sales and other taxes even if they pay no income taxes. There is no one in the united states who spends money who does not pay taxes.

Blake

April 17th, 2012

Timothy,

There are greater disparities of wealth within the top 1% than there are between those at the bottom of that 1% and the median taxpayer.

http://blogs.reuters.com/david-cay-johnston/2011/10/25/beyond-the-1-percent/

According to the above article, the tax burden falls squarely on the middle class (when the portion of the 1% which is in fact middle class is taken into account)…I guess it is a right-wing talking point.

Of course, all the more reason for a deduction free flat tax. I’d graduate it though. Especially within the 1% at the top.

Consider the Buffet Rule:

(the article dates from October 2011)

Priya Lynn

April 17th, 2012

My apologies Timothy – I was wrong:

“The economic top one percent of the population now owns over 70% of all financial assets, an all time record.”

http://www.alternet.org/economy/145705/the_richest_1%25_have_captured_america%27s_wealth_–_what%27s_it_going_to_take_to_get_it_back

Timothy Kincaid

April 17th, 2012

Priya Lynn,

If I remember correctly its more like they control 50% of the nations wealth – they control a higher percentage of the wealth than the percentage of taxes they pay.

I looked online before commenting.

Its a myth that the poorest pay no taxes. They pay various sales and other taxes even if they pay no income taxes. There is no one in the united states who spends money who does not pay taxes.

The lower half of income earners pay no income tax. Federal income tax is the method by which the nation funds itself.

Sales tax, property tax, business licenses, etc. are all state and local taxes.

Priya Lynn

April 17th, 2012

Timothy, I never said the poorest pay federal income taxes, I said they pay taxes – there are two types of taxes, income and sales and other taxes. The poorest pay taxes, all who buy things in the U.S. pay taxes contrary to your saying ““I believe that even the very poorest should pay SOME (albeit nominal) tax.â€.”. They do pay some tax so your statement does not follow.

The top 1% of the wealthiest Americans control 70% of the total weatlh in the U.S., not 30-40% as you claimed – see the link I posted.

Anyone who doesn’t acknowledge that this is proof of a dysfunctional society really needs to rethink everything they believe.

Priya Lynn

April 17th, 2012

In rereading the link I posted I missed that the top 1% control 70% of all financial assets which is different than total wealth. The top 1% control 50% of total wealth in the U.S.

http://www.commondreams.org/view/2010/01/17

Priya Lynn

April 17th, 2012

Further:

The working poor who may pay no federal income tax do pay payroll taxes which go to fund the federal government.

To re-iterate, it is a myth that the poorest Americans pay no taxes.

Timothy Kincaid

April 17th, 2012

Blake,

You’re going to have to help me with this one: “when the portion of the 1% which is in fact middle class is taken into account”

I’m just a poor simple tax accountant so I don’t exactly understand what that means.

But I do know that the author of that opinion piece holds truth as dearly as does Linda Harvey. Consider this sentence: “But how many people know that households making less than $75,000 collectively paid more federal income tax than those making $1 million or more?”

If you stop and think, of course they do. There are MANY more who make less that $75K so cumulatively they pay more than the far fewer who make over a million.

And look at this astonishing statistic: “The fact is that the government relies far more on the bottom 99 percent than the top 1 percent for federal income taxes.” Yes. Duh. It gets 63% of income from those 99 and only 37% from that one.

It’s all in the presentation and this guy is a spin doctor.

And, yes I agree. There are disparities between the real rates of income paid in taxes (which is why I support a flat tax with no loopholes) but the total numbers are real: The “wealthiest” already pay the vast majority of the taxes.

Ultimately what this whole “tax breaks for the wealthiest” nonsense turns out to be is an appeal to people who either don’t pay federal income taxes or pay very little that it is unfair – unfair I tell you – that billionaires pay less than millionaires – as though it has any impact on your life. It’s nothing more than a cynical appeal to “us v. them” which assumes that you aren’t smart enough to notice that both sides of the equation is “them”.

A single worker earning less than $90,000 pays a higher rate than [18.1%]

Sure, a single worker earning $90K with no dependents, no deductions, no exemptions, etc. will pay 16,256 or 20.2%. But is that what those 400 filed? I very much doubt it.

Who is that single worker? He certainly isn’t representative of anyone.

But the AVERAGE 90,000 income has 22,968 in itemized deductions. Plop that number in and he’s down to 10,306, an 18.1% tax rate – and that’s before dependents, education loan deductions or credits, or anything else.

But maybe Mr. Buffet is right that those 400 people should pay more. If he pulls out his checkbook I’ll let him use my pen.

Timothy Kincaid

April 17th, 2012

Priya Lynn

Timothy, I never said the poorest pay federal income taxes, I said they pay taxes

Okay… but the entire premise of the conversation is that its the due date for income tax returns and so it was pretty much understood that we were talking out income taxes. Being Canadian, perhaps you didn’t know that.

But let me address the “poor DO pay taxes” claim (similar to the “immigrants DO pay taxes” claim).

Sure, I guess that everybody “pays taxes” if we stretch the definition broadly enough. If you buy gasoline you pay taxes, though they are hidden.

But here’s how it falls out:

The lower half of workers pay no income tax. They are assessed Social Security and Medicare which – in theory – are not taxes but a form of involuntary investment group which is supposed to give you back those funds when you retire.

But yes, they are taxes. See what happens if you decide not to join the “investment group”. Further, they are taxes that tax lesser income but not higher income. Bizarre.

But they are tracked in a separate fund and are not supposed to be used for the costs of government. So it is not true that the poor pay taxes to fund the federal government. (Other, of course, than hidden taxes tucked away in your phone bill, at the pump, etc. – which don’t address my ownership point.)

I believe that it is in the best interest of the nation AND its poor that there be some easily identifiable income tax that they pay to fund the Federal Government (even if it’s only half of one percent or something). I believe that ownership is very very important and gives one a different view of their status in society.

As for sales tax, that’s a state issue. But considering that housing, fuel, food, and utilities are exempt, and considering the thriving street markets in Los Angeles and other major cities, the poor pay very little sales tax.

And that’s assuming you live in a state in which there is sales tax. Some – Nevada for example – have different funding methods (that state is basically funded by casinos).

But you can believe whatever myths fit your mood or worldview.

Timothy Kincaid

April 17th, 2012

And sorry. I’m neither socialist nor progressive. Here’s one reason why (though I have many).

Suppose that tomorrow we took all of the wealth in the nation and divided it equally among all the residents.

Woo hoo, now everyone can buy a lower model new car. Done.

But no one has enough to build a skyscraper. Or a shopping mall. Or to produce a movie. And certainly not build Carnegie Hall or Wrigley Field.

So, in order to do big things we need some scheme for compiling money. Ah, Government.

But now we are back with the poor having little and something else controlling the assets. But as it is Government, we all own it. Woo hoo.

Until George Bush III is elected and all the money goes to faith based initiatives and munitions factories. Ooopsie – we forgot that government is controlled by politicians. And that if history is any example, nasty capitalist billionaires tend to do more good in society than politicians. I’ll happily take a Bill Gates over a Sen. Inhofe any day.

Society cannot advance without some measure of accumulation of wealth. It probably never could but it certainly can’t today. But finding the line of what is best – verses what results in a society of extravagance and poverty – is a difficult one.

Yet if we can get over our resentment that it’s THEM and not ME that has the control over those assets then we can see that without such a process we wouldn’t have the things that make our lives enjoyable. And, if it helps, we can take solace in two facts:

The capitalist countries generally have less wild disparity in wealth and generally the poorest are less destitute than in non-capitalist countries. And as for the fools with the money – if they don’t use it wisely, they won’t have it for long. Someone with a better idea will … maybe you.

Timothy Kincaid

April 17th, 2012

Priya Lynn,

“The economic top one percent of the population now owns over 70% of all financial assets, an all time record.â€

Wow. Sounds impressive… but what does it mean?

Well that depends on how you define “financial assets”. Politifacts has a great article which helps understand. It’s from 2009 but it helps understand the difficulty of using bumper sticker approach to “THEM” (c’mon guys, we should know this from all the “homosexuals are” claims out there).

Here are the key points:

in 2004 the top 1 percent held 34.3 percent of the nation’s net worth (assets minus debts)

if you back out home ownership (how some define “financial assets”) then in 2001 the top 1 percent owned 39.7 percent of the financial wealth

if you further back out vehicles, real property, businesses and antiques and deal only with liquid assets (how others define “financial assets”) then the top 1 percent own 31.5 percent of the financial wealth

Adam

April 18th, 2012

Timothy:

“The capitalist countries generally have less wild disparity in wealth and generally the poorest are less destitute than in non-capitalist countries.”

If we are comparing developed “capitalist” countries with developed “non-capitalist” countries, your statement is just wrong. Compare the UK and the US as exemplars of capitalism with Sweden and Norway, representing the non-capitalist contingent. There’s much less inequality in non-captialist societies.

If you are comparing developed capitalist societies with developing non-capitalist societies, then you’re not controlling for confounding factors and your comparison is unhelpful at best.

Also, equality per se reduces negative social outcomes that lead to decreased overall well-being. OK, you might have more skyscrapers in the US, but is that more important than having a happier, less dysfunctional population?

Blake

April 18th, 2012

Excuse me while I scrape the shit off my shoe. But in the meantime; the pearl of truth in the spin Dr.’s article was that “the 1%” is a wholly arbitrary division of the taxpaying public, and looking at society threw a lens of “that 1%!” actually favors those within the 1% as that stratification is not reflective of class division in America.

A significant percentage of the 1% have more in common with the middle class (they work for their money, not the other way around); they may be on the extreme end of Upper Middle Class, but they are Middle Class by a certain definition (albeit not the classical definition). It is that top portion of the 1% which are the millionaires who are paying a smaller portion of their income in taxes than I am, my husband is, and all of his coworkers are (to give you about 20 examples of people who make less than 90K & have no deductions).

All the more reason for a deduction free flat tax. Although, as I said I’d like to see brackets at the very top. Those making more than $1M a year in a slightly higher tax bracket & on up per each additional 500K. These figures are arbitrary $10M might be a fine place to start & each additional $M a new bracket. But I support those brackets at the very top because I think it is in the USA’s best interest that people are discouraged from concentrating too much wealth into one family. Also, if we tax the very richest slightly more we can raise the minimum amount earned before the income tax kicks in. In your flat tax example (previously I haven’t read all your responses yet) you proposed $30K. Tax the rich a bit more & we can bump that up to $50K or $60K & a flat tax that kicks in after that. I think that’s a much fairer “flat” tax, in the best interest of the country, and one that you can actually get some Democrats to support.

Timothy Kincaid

April 18th, 2012

Blake

How is it “fair” that a person making 60k pay no federal tax?

My floor (though arbitrary) was based on compassion not greed or envy. If you do bother to read all of my shitty spin dr. comments you’ll see that I believe it important for e eryone to participate.

Jeez, when did “from each according to his abilities” just turn into “take from him not me”.

(and i think that it would be most accurate to describe the economic structure of Sweden and Norway as capitalist. You may disagree.)

Timothy Kincaid

April 18th, 2012

Oh, and Blake, I’m not understanding the anger and nastiness. It looks like we are in agreement on the solution – more or less

Blake

April 18th, 2012

OH I forgot about the credit we got for interest paid on our student loans! Does anybody have some cardboard?

Priya Lynn

April 18th, 2012

Timothy said “Wow. Sounds impressive… but what does it mean?

Well that depends on how you define “financial assets .”.

Apparently you didn’t read all my posts.

The top 1% control 50% of total wealth in the U.S.

http://www.commondreams.org/view/2010/01/17

Timothy Kincaid

April 18th, 2012

Priya Lynn,

I not only read your posts but perused the opinion piece you linked.

I marvel at you, I really do.

Priya Lynn

April 18th, 2012

Timothy said “But let me address the “poor DO pay taxes†claim (similar to the “immigrants DO pay taxes†claim).

Sure, I guess that everybody “pays taxes†if we stretch the definition broadly enough. If you buy gasoline you pay taxes, though they are hidden.”.

You seem to be implying that it is in someway unreasonable to call such taxes “taxes”, that there is some definition of taxes that reasonably excludes such taxes – there isn’t. You can reasonably claim such taxes are not “income taxes”, but income taxes are one specific tax included in the category of “taxes”. If you had said “I believe that even the very poorest should pay SOME (albeit nominal) income tax.†we wouldn’t be having this conversation. Its typical of fox news and republicans to use the fact that the poorest often pay no income taxes to claim the poorest pay no taxes whatsoever. That is a falsehood, please refrain from making such a claim in the future.

Timothy Kincaid

April 18th, 2012

Priya lynn,

Your ignorance about a thread topic does not obligate me to clarify what is already clear.

And thought you seem to be in “I MUST BE RIGHT” mode, I and the others whom you don’t like are not trying to distort.

While traveling in Sweden I might pay some tax on something. It doesn’t make me a Swedish taxpayer.

I think that the Fox point is that some people pay taxes as a significant portion of their expenditures. Others do not. Sales tax on a packet of bubblegum does not invalidate this observation.

Your argument is a bit like saying that because some gay person has molested a child therefore “homosexuals are pedophiles”. It a game of looking at words and insisting on being correct in some technical sense while ignoring the point entirely.

That’s a waste of time

Priya Lynn

April 18th, 2012

Your comments read like someone who did not read my posts, I marvel at you making the responses you did if you actually did read what I wrote. It seems the study is true – provide a republican proof that he is wrong and it makes him even more convinced he is right.

ZRAinSWVA

April 18th, 2012

“When all taxes (not just income taxes) are taken into account, the lowest 20% of earners (who average about $12,400 per year), paid 16.0% of their income to taxes in 2009; and the next 20% (about $25,000/year), paid 20.5% in taxes. So if we only examine these first two steps, the tax system looks like it is going to be progressive.

And it keeps looking progressive as we move further up the ladder: the middle 20% (about $33,400/year) give 25.3% of their income to various forms of taxation, and the next 20% (about $66,000/year) pay 28.5%. So taxes are progressive for the bottom 80%. But if we break the top 20% down into smaller chunks, we find that progressivity starts to slow down, then it stops, and then it slips backwards for the top 1%.”

The entire article is well worth the read. See http://www2.ucsc.edu/whorulesamerica/power/wealth.html

Blake

April 18th, 2012

Timothy,

I apologize. I will watch my tone. I am not angry, nor was it my intention to be nasty. I shall reread my comments before responding further.

Priya Lynn

April 18th, 2012

Timothy said “I think that the Fox point is that some people pay taxes as a significant portion of their expenditures. Others do not. Sales tax on a packet of bubblegum does not invalidate this observation”.

Please spare me the straw man. I don’t dispute that and I have no problem with people making such a statement. What I do have a problem with is Fox news saying “50% of Americans pay no taxes whatsoever” or you saying “I believe that even the very poorest should pay SOME (albeit nominal) tax.†and then outrageously claiming its okay to state such falsehoods because “some people pay taxes as a significant portion of their expenditures. Others do not.”.

Your equating the taxes poor people pay with the sales tax on a pack of bubblegum well illustrates your lack of objectivity on this issue.

Priya Lynn

April 18th, 2012

ZRAinSWVA, thanks for showing that 16% of $12400 is slightly more than the sales tax on a pack of bubble gum.

Priya Lynn

April 18th, 2012

Based on ZRAinSWVA’s comment I retract one statement I made in my comment before last.

16% of your income when you make $12400 a year or less IS a significant portion of a person’s expenditures. Having lived 10 years on $6000 a year I can certainly attest to that. When you’re poor 16% of your income is often the difference between eating every day of the week or buying clothes or paying your power bill. Timothy, do you know what its like to have nothing to eat for a week but a quart of milk and peanut butter?

When you’re a millionaire 30% of your income doesn’t deprive you of any of life’s necessities, or for that matter any significant portion of its luxuries. 16% of a poor person’s income is a far far bigger burden on that person than 30% of a rich person’s income is on them.

Timothy Kincaid

April 18th, 2012

Blake,

No problem. I get that way far too often. Fortunately when I get that “yeah, that was not appropriate” feeling right after I click send I have the luxury of removing the comment. :)

Regan DuCasse

April 18th, 2012

Wow. I did we run off the rails into a debate about taxes?

We really should stick to the indifference people like Brown have towards gay kids.

TownHall, WEEKLY will feature some gay bashing article that never misses an opportunity to turn it into America trending towards silencing and persecution of Christians who are speaking The Truth about homosexuality.

Brown, and Mike Adams especially take anecdotal, readily remedied situations, and make them sound like common epic battles happening all over America, with Christians in particular being at once victims AND victors of and against militant homosexuals.

Brown’s title, could be honorary for all we know. He’s a specialist in Easter languages. NOT gay people, nor their history.

Mike Adams is a professor of criminology at Duke. And whatever on campus issues that occur regarding changes in gay and lesbian conflicts (usually very minor), he keeps repeating the meme that ultimately, gay people are sexually insane and cannot be trusted.

He continues to push the stereotype especially that gays are pedophiles.

With his credential in criminology, he implies expertise in the higher risk groups for criminal activity.

So these men portray themselves as trusted academics and expert on gay people, and all the while push inaccurate, stereotypical and outright lies.

And any gay or het allies, pretty much get dismissed as deluded children when challenging him.

He’s very two faced. He sure had a whole different approach when he posted some comments at ExGayWatch for a while.

They are clever yes, but they are the ugliest (and most cowardly) of people in just what they are doing and how they do it.

Timothy Kincaid

April 18th, 2012

Priya Lynn,

If you had said “I believe that even the very poorest should pay SOME (albeit nominal) income tax.†we wouldn’t be having this conversation.

What I said was

“Tax breaks for the poorest†is not a possibility… half of the employed pay no income tax at all.

…

I believe that even the very poorest should pay SOME (albeit nominal) tax. It makes them an equal partner. It means they have both the right and obligation to care about the country and are not just residents but citizens. [emphasis added]

If you were unaware that I was talking about income tax – and specifically federal income tax – perhaps that error doesn’t lie with me.

Timothy Kincaid

April 18th, 2012

ZRAinSWVA

Thanks for the link. I’ll check it out before I comment further.

Blake

April 18th, 2012

Timothy,

Thanks for understanding. I think I fail at posting sometimes because I forget how human communication works when its broken down into written words.

Two points/responses about taxes/Capitalism & then I’m done:

One of my favorite things about Scandinavians are their income-proportional traffic tickets. It strikes me as much more fair than our system of 1 fine for all. Why then is the same principal unfair in taxation? Or are you saying the principal itself is misguided?

I’m not a socialist either, although I do believe Global Capitalism to be immoral (I, perhaps foolishly, believe GC can be reformed into a moral system). Capitalism looks good in the big picture. Especially when one says progress necessitates the accumulation of wealth. But such a statement puts the cart before the horse.

The accumulation of wealth does not guarantee progress. How much accumulated capital has been spent selling & “innovating” razor blades or shampoo or cheese or rubber-stamps or keyboards? It has to have been at least 100 years since the last time Capitalism has been at the heart of any meaningful innovation which shifted (or “progressed”) society. Can you come up with one? I honestly can’t think of one since the cotton gin, but I may be blinded by my own prejudice.

Timothy Kincaid

April 18th, 2012

Timothy, do you know what its like to have nothing to eat for a week but a quart of milk and peanut butter?

This is a logic fallacy – a variation on the appeal to authority: my views are correct because I have experiences that you don’t have. It also assumes that the only legitimate and reasonable conclusions to draw from those experiences are the ones I’ve drawn and therefore (using a variation of “no true scotsman”) if you disagree, you must not know what it’s like.

But you are wrong. Yes, Priya Lynn, I do know what it is like to struggle.

Blake

April 18th, 2012

Indeed Timothy it is a logical fallacy, but it does not distract from her point:

Millionaires can afford to give up 30% of their income; most other people can’t.

Timothy Kincaid

April 18th, 2012

Blake

One of my favorite things about Scandinavians are their income-proportional traffic tickets. It strikes me as much more fair than our system of 1 fine for all. Why then is the same principal unfair in taxation? Or are you saying the principal itself is misguided?

Taxes (other than the hidden ones) generally are income proportional. Whether incremental (what we currently have) or flat rate (what I prefer), the more you earn, the more you pay.

Where it gets screwy is when we decide that traffic tickets get a pass if you work in green energy or grow corn. Or that with each additional child you get to run more red lights. (metaphorically speaking)

While I prefer flat rate, I would be fine with incremental (other than that I believe it detrimental to economic growth – and yes I know other economic theories disagree).

What I do NOT agree with is using the tax code to try and manipulate the economy to go in directions that the market wont support or to pay off buddies that contributed to your campaign.

When it’s not plain ol’ corruption, it’s almost always self-defeating. The American Dream notion of “helping the working guy pay for a home” by reducing his taxes for his interest payments only inflated housing costs (the market charges what people can afford – with gov. subsidies, what they could afford went up) and while land speculators made a fortune, it became even more difficult for the lower middle-class to buy a home. (And when the solution was to just lend anyway to people who couldn’t pay the mortgage, the result was catastrophic).

Timothy Kincaid

April 18th, 2012

Blake

It has to have been at least 100 years since the last time Capitalism has been at the heart of any meaningful innovation which shifted (or “progressedâ€) society. Can you come up with one?

Put down your pencil and stop writing on that pad of paper, stick it in an envelope and mail it to me and I’ll get back to ya in about a week.

;)

The 20th Century is perhaps the period in which the most astonishing of man’s ingenuity was tapped. When my grandmother was born, clothes were washed in metal washtubs, horses were transportation, and communication was the finest that the US Postal Service had to offer. Most of the changes were driven by a taking a natural curiosity and marrying it to a desire to succeed.

Some day read up on Nicola Tesla (though he does fall just at the edge of 100 years). That man was driven by capitalist ideals (and hucksterism and a life-long feud with Edison). We are only now utilizing some of his ideas (like wireless energy transfer) and still don’t know how he did some of what he did. For a more modern example, put down the iphone, get off the MacBook Air, set aside the ipad, pull the ipod out of your ears and really think to see if you can come up with a world changing capitalist.

Blake

April 18th, 2012

Timothy, I’m picking up what you’re putting down. Of course I think you’re missing the bigger picture when you say Taxes generally are income proportional.

While technically true not all taxes have a proportional affect on each individual. A flat tax would have a proportionally larger affect on those at the low end. Raise the bar lessen the asymmetry in affect. Hence a slightly progressive flat tax with a higher threshold (but with a marginal amount payed by everyone) would be more fair than a flat tax with a lower bar.

Otherwise we are in perfect agreement when it comes to the need to reform our tax code.

Timothy Kincaid

April 18th, 2012

ZRA, et al.,

If your objection is that the very very wealthy pay a lower percentage of income than the very wealthy, I really have no argument to counter that. They still pay more than the less wealthy do, so I’m not sure about the outrage. Ideologically, I see your point and agree, but I just am having trouble coming up with sympathy for those making more than 99% of the rest of the country.

(But, then again, if I were part of the very wealthy I might be a bit miffed.)

And while we may find an example of a Poor Paul who pays a higher percentage than a specific Rich Rick, I believe that the average of Poor Pauls pay a lower percentage than the average of Rich Ricks.

Timothy Kincaid

April 18th, 2012

Blake,

I hear what you’re saying, but I’d have to see the numbers.

As far as impact, I think a floor would eliminate any non-optional impact. Yes the guy making 50K may not be able to have as many lobster dinners as the guy making 50 million and paying the same rate, but I don’t care. In fact, I kinda see that as a good thing. In so far as the basics are not impacted (minimal food, shelter, and necessities), a quest for the good life stimulates the economy.

(And we all know that we really don’t need the new iPad.)

But you are right. I think our disagreement is in application and details. And while I like my idea, your idea is better than what we have.

ZRAinSWVA

April 18th, 2012

Timothy wrote, “They still pay more than the less wealthy do, so I’m not sure about the outrage.”

No outrage on my part; rather a whole lot of sympathy for those who do work hard for a modest wage and knowing how hard it is for them to get ahead.

Not to veer further off topic, but I would compare this to a parking permit fee discussion we’ve had where I work: we all pay the same amount for them, whether we make X00,000’s per year or minimum wage. However, that permit fee is a considerably larger percentage of the low wage workers take-home pay, while those making very large salaries don’t even notice. We’ve talked ad nauseum about prorating the fee based on salary, but that’s not gained any traction largely because of objections raised by those making very large salaries–who also dominate, not coincidentally, our administration. I have an ethical problem with this approach, and the same would apply to our tax system.

Priya Lynn

April 18th, 2012

Timothy said “This is a logic fallacy – a variation on the appeal to authority: my views are correct because I have experiences that you don’t have. It also assumes that the only legitimate and reasonable conclusions to draw from those experiences are the ones I’ve drawn and therefore (using a variation of “no true scotsmanâ€) if you disagree, you must not know what it’s like.”.

No, I didn’t say my views are correct because I have experiences you don’t have or that the only reasonable conclusions to draw from those experiences are the one’s I’ve drawn so there is no logical fallacy – you inferred something I didn’t say.

Timothy said “But you are wrong. Yes, Priya Lynn, I do know what it is like to struggle.”.

That’s not surprising, but I doubt you know what its like to struggle like that every two or three months for 10 years or a lifetime.

What most conservatives seem to miss is as Blake pointed out (and I’m trying to)that while some wealthy people pay a higher percentage of their income in taxes than some poor people it is a much greater burden on the poor people than on the rich people. For example, when I was making $6000 per year taking away even $600 of that in taxes caused me far, far more hardship than it would cause Mitt Romney if someone took away 90% of his 18 million a year income. I’d like to see Republicans like you acknowledge that its a far far greater burden on someone making less than $12000 a year to pay 16% of that in taxes than it is for a millionaire to pay 30% in taxes

Timothy said “And while we may find an example of a Poor Paul who pays a higher percentage than a specific Rich Rick, I believe that the average of Poor Pauls pay a lower percentage than the average of Rich Ricks.”.

I don’t have the numbers with me but I know they frequently cover this a lot on MSNBC and that is not entirely true. If I remember correctly the one percent pay about a 15% total tax rate* or less while those making 50,000 a year or less pay around 25-30%. As Warren Buffet says, he pays a lower tax rate than his secretary and that is typical.

*actually its 16.6%:

http://www.ourfuture.org/blog-entry/2010020718/top-1-lower-tax-rate-their-secretaries

If you’re under the impression that rich people typically pay a higher tax rate than relatively poor people, that is most certainly not the case.

Timothy Kincaid

April 18th, 2012

ZRA,

Ah… there are taxes and then there are taxes. And those stats include items that are neither.

Professor Domhoff bases his claims on the Center for Tax Justice (which appears to be an advocacy group). As best I can tell, the definitions are crafted to discuss impact of taxation rather than payment of taxes.

Yes it is true in a sense that “even renters pay property tax” because the landlords pass the increased tax to them in the form of higher rent. It’s also true in a sense that we all pay corporate tax because corporations pass on the tax to customers in the form of higher prices. But including either is not really particularly relevant to this conversation.

(By comparison, if someone works as household help for a CEO, any tax on him might be reflected in a reduction in the hours he can hire her. But I have not heard anyone claim that we ought not increase taxes on CEOs because those taxes are really paid by his household help.)

And their numbers don’t seem to flow. Each report refers to another, but when you get down to it, Who Pays lists the average [state and local] tax rate on the lowest 20% at 10.9 percent, of which 7% is sales tax and 3.5% is property tax. I don’t know what the other 6% is comprised of, though I suspect it is payroll tax.

Those numbers, in and of themselves seem to lack credibility.

First, it seems fascinating that the property tax on apartment buildings is a tax on the wealthy land-baron fat cat when it’s time to raise taxes, but a regressive burden on the poor when time to lament the plight of the little guy and defend the claim that “he pays taxes too”. And, of course, few who see rent as evidence of paying taxes notice that they are defending Ronald Reagan’s “trickle-down economics”.

So, for sake of honesty in this conversation, let’s say “no, renters don’t pay property tax.” Increased taxes (in total) cost all of us, and decreased taxes (in total) benefit all of us (or at least if we are applying the proptax=rent theory) but that’s a distraction for this conversation.

Now as to sales tax: that’s mathematically impossible.

Take, for example, California. With a sales tax rate of about 8% (it varies by county) the report claimed that the lowest 20% pay 6.5% of their income in sales tax.

But housing, food, medicine, and utilities are not subject to sales tax. In order for them to be paying 6.5% of their income in sales tax, they would have to be spending less than 20% of their income on essentials.

That is absurd.

Part of that number is excise taxes: the per gallon tax on gasoline, the per bottle tax on booze, and the per pack tax on cigarettes.

But the real number crunching comes from creative definitions.

Of the 6.5, the sales tax they pay is 3.2%. Then there is “other sales and excise – ind.” and “sales and excise – business”. I didn’t see a ready definition, but they seem to be taxes on individuals or businesses that flow through to the poor guy by means of higher prices or lower wages.

So of the total 10.9% that the poorest 20% pay, they only pay 3.2%. The rest is paid by someone else – though, like oil prices, crop failure, technological breakthroughs and lottery winners, they can impact that poorest 20%.

Add that to the financial oddity that is Social Security and Medicare (the house member that called it a ponsi scheme wasn’t far off), and the poorest pay zero taxes toward the federal government, 7.5% of their income towards their mandatory retirement plan, and 3.2% of their income towards state and local government.

I’ll admit that 3.2% was higher than I expected. And for that to be true either the poor have a much higher level of expendable income than expected (around 40%) or they drink, smoke and take long drives at rates that stagger the mind. But let’s accept it and note that it’s definitely more than the tax on a pack of gum – somewhere between $25 and $30 per month.

Timothy Kincaid

April 18th, 2012

Priya Lynn,

To the best of my knowledge, everyone agrees that 5% of $6,000 is far far more costly than 5% of $600,000.

Forgive me, but I have to point out that in this you and I both agree with the principle found in a story in the Bible.

Jesus and his disciples observed some people giving to the treasury. Some came with grand gifts but one widow woman quietly dropped in two mites (a few cents). Jesus pointed her out to his disciples and said that she gave far more than anyone else – she gave all she had.

But as for your numbers…. well, let’s just say that you hold anti-gay activists to a stricter standard than you do progressive activists.

I’m sure Warren Buffet pays less in taxes than he should. But let’s not pretend that his “secretary” makes $50K.

And that’s kinda why it irks me when he uses that example. Because her title sounds like a lower paid employee it skews perception. If he said, “my chief financial planner” pays more, no one would flinch.

But “secretary” sounds like a $25 – $50K job and there’s no way that’s what he pays her. An executive secretary to a billionaire makes more than you and I will ever dream of making combined.

And yes I am under the impression that rich people typically pay a higher tax rate than relatively poor people. All of the statistics I’ve seen (including those presented by ZRA) suggest that this is the case. (The top 1% pay less of a rate than the next 19%, but still more than the bottom 80%)

Timothy Kincaid

April 18th, 2012

And, by the way, the issue isn’t incremental income taxes. It’s capital gains tax which means that a gain on buying and selling stock is taxed at a lower rate than earned income.

But tax law skews the impression it gives.

If in 2009 Suzy earns 200K in income and 100K in good stock investment, she’s taxed on $200K income tax and $100K capital gains tax (15%). And she shows up in the stats as a $300K earner.

If in 2010 Suzy earns $200K in income and loses $100K in bad stock investments, she doesn’t get to take all that loss. Instead she is limited to $3,000 loss and is taxed on 197K income tax. She shows up this year in as a lower earner.

Over the two years, Suzy was taxed on her wages at her income tax rate, but paid taxes of about $15,000 on a net of nothing. Over time she’ll recap that loss (at $3K per year) but the tax statistics reporting doesn’t reflect reality. And those top 400 are almost never the same year to year so their fluctuation makes it difficult to judge what they really are being taxed year to year.

Most of the uber-wealthy have capital rather than earned income. The Warren Buffet rule would be unnecessary if capital taxes were the same rate as income taxes. But then little old ladies in lower tax brackets who live on their dividends would pay higher taxes. And we can’t have that, can we? They’re little. And old.

Timothy Kincaid

April 18th, 2012

Regan,

Yep. We ran off the tracks. Forgive me, taxes have been my life for the past few months.

Priya Lynn

April 18th, 2012

No, Timothy, I don’t know that Warren Buffet’s secretary makes more than $50,000. You can assert that she does but I’m under no obligation to accept your assertion on your word alone.

Timothy said “(The top 1% pay less of a rate than the next 19%, but still more than the bottom 80%).

You’re wrong about that. The top 1% pay 16.6% income tax, many in the bottom 80% are paying 30% or thereabouts income tax. The bottom 20% pay 16% in total taxes, so not as high a rate as the top 1% but certainly great deal more burdensome a total than the top 1% pay. You can play games with statistics and use the lowest income earners to say the top 1% pay more taxes than the bottom 80% but that’s very misleading and would falsely encourage people to believe the top 1% pay a higher tax rate than the next 50%, a situation most people find wrong. Aproximately 70% of Americans agree that the wealthy don’t pay their fair share of taxes, you’re in the minority if you think there is a reasonable equitability in the American tax rate

When we’re talking about fairness and equally sharing the burden those earning under $20,000 a year with children most certainly shouldn’t</i) be paying any income tax. And if we exclude the lowest income earners and look at those paying $30-50,000 a year, they are paying WAY more than their fair share and a great deal higher tax rate than the top 1%. NO way should those earning 30-50,000 a year be paying higher tax rates than the top 1% but they are.

You glibbly say "But let’s accept it and note that it’s definitely more than the tax on a pack of gum – somewhere between $25 and $30 per month." which shows me you certainly haven't struggled much in your life. $20 or $30 a month may be nothing to you, but when you make $6000 a year its pretty significant. That you'd equate $20 or $30 with the 5 or 10 cents of tax on a package of gum shows you've lived a pretty privileged life.

Getting back to what I asked you earlier, please acknowledge that paying 16% taxes on a yearly income of $12000 or less is a much greater burden on a person than paying 30% taxes on 1 million a year or more. Or is that too much to ask of you?

Priya Lynn

April 18th, 2012

I wrote “And if we exclude the lowest income earners and look at those paying $30-50,000 a year, they are paying WAY more than their fair share”, I meant to say “And if we exclude the lowest income earners and look at those earning $30-50,000 a year, they are paying WAY more than their fair share”. Equal isn’t always equitable. A fair sharing of the tax burden necessitates the rich paying progressively higher rates than the poor.

Timothy Kincaid

April 18th, 2012

Priya Lynn,

Is that your argument? That the top are paying 16.6% on average but many in the bottom 80% are paying 30% or thereabouts income tax?

I’ll tell ya what, I won’t even challenge that comparison and I’ll let you just tell yourself what you would tell me if I tried comparing the average of one group with “many” in another.

And here’s a news flash for you: no one in the bottom 80% is paying 30% of their income in federal income taxes. No one. It isn’t mathematically possible.

Assume that they filed as married filing separately (the highest rate) and had zero deductions, credits, or extenuating circumstances. The first 9,500 of income is tax free. The next 8,500 (total of 18,000) is taxed at 10% for a total tax of $850 (or 4.7%). Rates increase to 15, 25, 28, 33, and finally 35%.

But due to incremental taxation, this individual would not have an incidental tax rate (the next dollar taxed) of over 30% until his salary reached $189,575 and he wouldn’t pay a 30% income tax rate until he made $368,175.

He isn’t in the bottom 80%.

And NO, the bottom 20% DO NOT PAY 16% IN TOTAL TAXES. That is an inflated number based on presenting taxes PAID BY OTHER PEOPLE as being taxes paid by this group.

When anti-gays present untruthful statistics you call them a liar. What is it when you do it, Priya Lynn?

I’m not the one playing games here. I’m not the one assigning people to “pay” taxes that they don’t pay.

I can’t discuss your premises, Priya Lynn, or listen to the merits of your argument if you use total fabrications as your arguing points.

You can play games with statistics and use the lowest income earners to say the top 1% pay more taxes than the bottom 80% but that’s very misleading and would falsely encourage people to believe the top 1% pay a higher tax rate than the next 50%, a situation most people find wrong.

The top 1% DO PAY A HIGHER RATE than the next 50%. Your saying that they don’t doesn’t make it true.

You don’t have to believe me. But surely the Congressional Budget Office knows what they are talking about.

Look, you don’t have to believe a word I say. But do yourself a favor. Go do research. Not to hunt down some opinion which throws in the bus fare to the post office and postage to the IRS, but for the real numbers. Do it not to have the last word, but so you will know what you are talking about.

Sometimes it is better to be factually correct than to “be right”.

Timothy Kincaid

April 18th, 2012

Priya Lynn,

And if we exclude the lowest income earners and look at those paying $30-50,000 a year, they are paying WAY more than their fair share and a great deal higher tax rate than the top 1%. NO way should those earning 30-50,000 a year be paying higher tax rates than the top 1% but they are.

Okay, now you get to show proof.

Getting back to what I asked you earlier, please acknowledge that paying 16% taxes on a yearly income of $12000 or less is a much greater burden on a person than paying 30% taxes on 1 million a year or more. Or is that too much to ask of you?

And getting back to my response,

Did you not see that we agreed in principle here? Did i need to use your numbers for you to understand?

But that’s a false comparison (I was trying agree in principle and let you off on the false premise). No one making $12,000 pays 16% in taxes. Please acknowledge that fact. Or is that too much to ask of you?

Timothy Kincaid

April 18th, 2012

You glibbly say “But let’s accept it and note that it’s definitely more than the tax on a pack of gum – somewhere between $25 and $30 per month.” which shows me you certainly haven’t struggled much in your life. $20 or $30 a month may be nothing to you, but when you make $6000 a year its pretty significant. That you’d equate $20 or $30 with the 5 or 10 cents of tax on a package of gum shows you’ve lived a pretty privileged life.

Your absurd assertions about my life really go beyond the pale.

I didn’t glibly say anything. I’m aware that 25-30 can be significant. For parts of my life that was VERY significant. You don’t know me, lady, and every time you make a guess about what you are sure I must be like, you get it about as wrong as is possible. (Remember when you and another commenter insisted that I must be a fair skinned, blue eyed blond? You actually argued with me about my own skin color.)

And besides I don’t need to answer to your misplaced values. There’s no merit in struggling. There’s no nobility to poverty. One doesn’t gain insight into economic theory by doing without. Poor people are like rich people, just without money. Some are truly good, and others are selfish and careless and blinded by hate.

So take your stupid arrogant assumptions and pack them away for someone who deserves them.

I’ll take an apology now.

Timothy Kincaid

April 18th, 2012

According to the Tax Policy Center, a project of the Brookings Institute and the Urban League (in other words – not rightwingers):

http://www.taxpolicycenter.org/numbers/displayatab.cfm?Docid=2972&DocTypeID=7

Jim Burroway

April 18th, 2012

My comment makes the 65th comment on this thread. I haven’t been following comments here, and thank god for that (to borrow an expression.) The first 11 comments were on topic. The fact that the12th, which derailed this entire thread, actually begins with “Off topic, but…” should have been a clue that the subject introduced was, in fact, off topic. I haven’t bothered to slog through the remaining 52 comments carefully, but a quick perusal suggests that, I think, maybe one of them actually addressed this post.

I apologize for failing to monitor this thread.

But I am monitoring it now.

Timothy (TRiG)

April 24th, 2012

That, I must say, is not how I read it. I’m going to take the story at face value here, assuming that she did in fact say Let them eat cake and that she meant cake as we would understand it today.

I don’t read that as the statement of an oblivious lady who doesn’t realise that a shortage of bread implies also a shortage of cake. I read it as a careless joke made by someone so insulated from the realities of life that she can joke about people starving.

Perhaps I’m wrong.

***

Timothy, that policy has been tried before. It didn’t work.

TRiG.

Leave A Comment