Box Turtle Bulletin

News and commentary about the anti-gay lobby

News and commentary about the anti-gay lobby News and commentary about the anti-gay lobby

News and commentary about the anti-gay lobbyMay 20th, 2010

Following up on its commitment to recognize same-sex marriages conducted outside of the state, Maryland will now provide marriage benefits to same-sex married state employees. (WaPo)

State employees in Maryland can now sign up same-sex spouses as dependents, making them eligible to receive the same health care and other benefits afforded to husbands and wives of heterosexual state employees, according to Gov. Martin O’Malley’s (D) office.

The change, made public Wednesday, means that O’Malley’s administration has followed through in codifying a legal opinion issued in February by Maryland Attorney General Douglas F. Gansler.

Latest Posts

Featured Reports

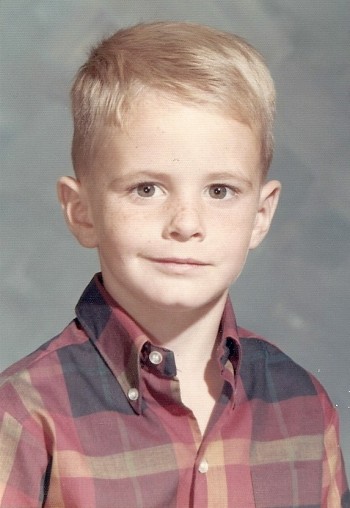

In this original BTB Investigation, we unveil the tragic story of Kirk Murphy, a four-year-old boy who was treated for “cross-gender disturbance” in 1970 by a young grad student by the name of George Rekers. This story is a stark reminder that there are severe and damaging consequences when therapists try to ensure that boys will be boys.

In this original BTB Investigation, we unveil the tragic story of Kirk Murphy, a four-year-old boy who was treated for “cross-gender disturbance” in 1970 by a young grad student by the name of George Rekers. This story is a stark reminder that there are severe and damaging consequences when therapists try to ensure that boys will be boys.

When we first reported on three American anti-gay activists traveling to Kampala for a three-day conference, we had no idea that it would be the first report of a long string of events leading to a proposal to institute the death penalty for LGBT people. But that is exactly what happened. In this report, we review our collection of more than 500 posts to tell the story of one nation’s embrace of hatred toward gay people. This report will be updated continuously as events continue to unfold. Check here for the latest updates.

In 2005, the Southern Poverty Law Center wrote that “[Paul] Cameron’s ‘science’ echoes Nazi Germany.” What the SPLC didn”t know was Cameron doesn’t just “echo” Nazi Germany. He quoted extensively from one of the Final Solution’s architects. This puts his fascination with quarantines, mandatory tattoos, and extermination being a “plausible idea” in a whole new and deeply disturbing light.

On February 10, I attended an all-day “Love Won Out” ex-gay conference in Phoenix, put on by Focus on the Family and Exodus International. In this series of reports, I talk about what I learned there: the people who go to these conferences, the things that they hear, and what this all means for them, their families and for the rest of us.

Prologue: Why I Went To “Love Won Out”

Part 1: What’s Love Got To Do With It?

Part 2: Parents Struggle With “No Exceptions”

Part 3: A Whole New Dialect

Part 4: It Depends On How The Meaning of the Word "Change" Changes

Part 5: A Candid Explanation For "Change"

At last, the truth can now be told.

At last, the truth can now be told.

Using the same research methods employed by most anti-gay political pressure groups, we examine the statistics and the case studies that dispel many of the myths about heterosexuality. Download your copy today!

And don‘t miss our companion report, How To Write An Anti-Gay Tract In Fifteen Easy Steps.

Anti-gay activists often charge that gay men and women pose a threat to children. In this report, we explore the supposed connection between homosexuality and child sexual abuse, the conclusions reached by the most knowledgeable professionals in the field, and how anti-gay activists continue to ignore their findings. This has tremendous consequences, not just for gay men and women, but more importantly for the safety of all our children.

Anti-gay activists often charge that gay men and women pose a threat to children. In this report, we explore the supposed connection between homosexuality and child sexual abuse, the conclusions reached by the most knowledgeable professionals in the field, and how anti-gay activists continue to ignore their findings. This has tremendous consequences, not just for gay men and women, but more importantly for the safety of all our children.

Anti-gay activists often cite the “Dutch Study” to claim that gay unions last only about 1½ years and that the these men have an average of eight additional partners per year outside of their steady relationship. In this report, we will take you step by step into the study to see whether the claims are true.

Tony Perkins’ Family Research Council submitted an Amicus Brief to the Maryland Court of Appeals as that court prepared to consider the issue of gay marriage. We examine just one small section of that brief to reveal the junk science and fraudulent claims of the Family “Research” Council.

The FBI’s annual Hate Crime Statistics aren’t as complete as they ought to be, and their report for 2004 was no exception. In fact, their most recent report has quite a few glaring holes. Holes big enough for Daniel Fetty to fall through.

The FBI’s annual Hate Crime Statistics aren’t as complete as they ought to be, and their report for 2004 was no exception. In fact, their most recent report has quite a few glaring holes. Holes big enough for Daniel Fetty to fall through.

tina

May 20th, 2010

first of all, I loved that headline. :)

now i have a question. I’ve heard that b/c of DOMA/lack of federal recognition of gay marriage, that the benefits awarded to gay couples are taxed differently.

a friend told me that her company in PA did make the switch to allow their gay employees’s partners to be covered.

2 problems:

1. the benefits cost more b/c they were not federally recognized as married. her company covered the additional costs, but they were then eligible to be taxed as income.

2. she owed 2,000 in taxes at the end of the year on these benefits. a very bad surprise.

is this always the case?

can someone concisely explain how benefits are or are not equal for married gay couples?

Timothy Kincaid

May 21st, 2010

tina,

I don’t think that it is accurate that the insurance rate (the cost) is any higher for the company than any other spouse’s insurance. I know of no insurance company that does not treat spouses as spouses regardless of whether gay or straight.

But you are correct that they are taxed differently.

If Joe’s wife’s health insurance is covered by his employer, it’s just a benefit.

But if Gary’s husband’s health insurance is covered by Gary’s employer, then the cost of the insurance is Federal taxable income paid to Gary.

Leave A Comment