Box Turtle Bulletin

News and commentary about the anti-gay lobby

News and commentary about the anti-gay lobby News and commentary about the anti-gay lobby

News and commentary about the anti-gay lobbyApril 7th, 2011

It is tax time and across the country individuals and families are finalizing their income tax returns and trying to makes heads or tails out of Alternative Minimum Tax and Capital Loss Limitations and Net Operating Loss Carrybacks and Itemized Deduction Phase Outs and a whole host of other intricacies of adherence to the federal tax code.

But for same-sex couples, the confusion starts with Box One, filing status. What is the filing status of a same-sex legally married couple?

Well, that depends. There simply isn’t a clear answer.

Due to DOMA, the Defense of Marriage Act, the federal government currently takes the position that you are roommates – legal strangers – who share residency but not lives. Theoretically, one might expect to see rental income or gift tax or other such items on returns, though, to their credit, the IRS does not apply such rigidity to either gay or straight cohabiting couples.

So the final answer (so far) is that you file as single (or as head-of-household if you qualify). But that doesn’t necessarily mean that you report your income as though you were single.

Because the IRS, while not recognizing your marriage, may recognize your legal right to your spouse’s income. And that depends on where you live.

If your state has community property laws, then you have a claim on half of the income of your heterosexual spouse. But some states have also applied community property laws to same-sex relationships, whether called marriages, civil unions, or domestic partnerships. In California, for example, one half of a same-sex couple has a legal claim on half of her partner’s income whether she is in a domestic partnership or got married in the 2008 window.

And the IRS is now taking the position that if you have a claim on it, you need to report it. So in California, for example, each half of the partnership would claim half of the partnership’s community property income (being careful to exclude income that does not fall into this category) and prepare income tax returns as “Single” to report their share. In Massachusetts, not a community property state, the same couple would segregate their income and prepare “Single” income tax returns reflecting only their own income.

All of which is thrown out the window for state return preparation. Each state defines who is or who is not married and requires those couples which they recognize as married to file as “Married”. Some, like California, require that domestic partnerships or civil unions prepare “Married” returns.

But that isn’t the extent of it. Most states don’t duplicate the entire return calculation process but instead start with the federal numbers and make adjustments. So while you cannot file a joint federal return, in order for the state to have a starting point, you must prepare a joint federal return so as to come up with the numbers you would report were you allowed to do so.

Thus, depending on where you live, your income tax return for the state could be filed with a different status than your federal income tax return, your state return could be based on a federal return which will never be filed, and your federal return may or may not recognize a portion of your income as jointly earned though reported as though single.

Confused? You should be.

So now a group of married same-sex couples have started a campaign to Refuse To Lie about their marriage status. As they are legally married in the eyes of their state, they find it offensive – legally and morally – to be forced to say that they are not. And just as there is an inherent indignity to being forced to annually tick a box labeled “I’m inferior”, so too is in unconscionable to force citizens to tick a box that is premised in that concept. (New York Times)

“More people are refusing to lie on those forms, even though the government is telling them to,” said Nadine Smith, executive director of the gay, lesbian, bisexual and transgender advocacy group Equality Florida, who plans on filing a joint return with her wife, Andrea. “It would be both dishonest and deeply humiliating to now disavow each other or our marriage and declare ourselves single on our tax form.”

This is not a new concept. I’ve heard of tax rebels who have, for years, flouted the tax code and took a stand for equality. Such efforts tend to be ineffective and costly. The IRS is not a compassionate or forgiving institution.

But this year may be different. The Defense of Marriage Act has been declared to be in violation of the US Constitution, the Justice Department has determined it to be indefensible, and there is no presumption that the SCOTUS will uphold the law. So it is not unreasonable to act accordingly (though the campaign notes that you must act in a manner that is in conformity with the IRS’s procedures for challenging positions, not haphazardly).

My best guess is that if and when DOMA is overturned, it will not be retroactive. In other words, for 2010 you will most likely be required to file as strangers even if DOMA is tossed out. But those who challenge the provision probably will not face punitive action or be accused of tax fraud.

Should you decide to prepare your taxes using Married status, the smartest action would be to place the difference in taxes in a trust account to be released upon determination of the DOMA challenges and be very very careful. And don’t expect your tax accountant to go along with you; accountants are increasingly being held liable for their client’s positions.

But there are other options that I find both safe and smart.

The “Refuse to Lie” Web site warns same-sex couples of the risks of filing jointly, and explains different options to both adhere to the law while expressing that they disagree with it. One way to do that would be to put an asterisk by the “single” box, and then indicate at the bottom of the tax form that you are “only single under DOMA.” Another option, the site says, is to attach a note with a similar message.

They can’t punish you for “providing a full disclosure” and such a stand can give you something to talk about around the water cooler. (And never underestimate the world-changing power of water-cooler conversation)

Latest Posts

Featured Reports

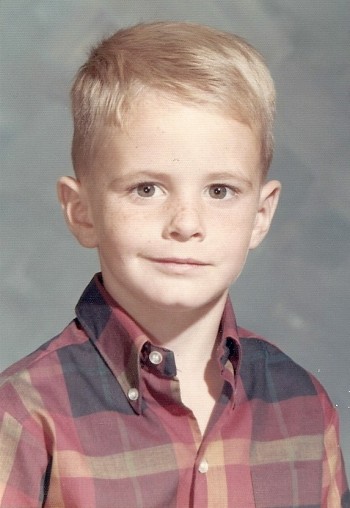

In this original BTB Investigation, we unveil the tragic story of Kirk Murphy, a four-year-old boy who was treated for “cross-gender disturbance” in 1970 by a young grad student by the name of George Rekers. This story is a stark reminder that there are severe and damaging consequences when therapists try to ensure that boys will be boys.

In this original BTB Investigation, we unveil the tragic story of Kirk Murphy, a four-year-old boy who was treated for “cross-gender disturbance” in 1970 by a young grad student by the name of George Rekers. This story is a stark reminder that there are severe and damaging consequences when therapists try to ensure that boys will be boys.

When we first reported on three American anti-gay activists traveling to Kampala for a three-day conference, we had no idea that it would be the first report of a long string of events leading to a proposal to institute the death penalty for LGBT people. But that is exactly what happened. In this report, we review our collection of more than 500 posts to tell the story of one nation’s embrace of hatred toward gay people. This report will be updated continuously as events continue to unfold. Check here for the latest updates.

In 2005, the Southern Poverty Law Center wrote that “[Paul] Cameron’s ‘science’ echoes Nazi Germany.” What the SPLC didn”t know was Cameron doesn’t just “echo” Nazi Germany. He quoted extensively from one of the Final Solution’s architects. This puts his fascination with quarantines, mandatory tattoos, and extermination being a “plausible idea” in a whole new and deeply disturbing light.

On February 10, I attended an all-day “Love Won Out” ex-gay conference in Phoenix, put on by Focus on the Family and Exodus International. In this series of reports, I talk about what I learned there: the people who go to these conferences, the things that they hear, and what this all means for them, their families and for the rest of us.

Prologue: Why I Went To “Love Won Out”

Part 1: What’s Love Got To Do With It?

Part 2: Parents Struggle With “No Exceptions”

Part 3: A Whole New Dialect

Part 4: It Depends On How The Meaning of the Word "Change" Changes

Part 5: A Candid Explanation For "Change"

At last, the truth can now be told.

At last, the truth can now be told.

Using the same research methods employed by most anti-gay political pressure groups, we examine the statistics and the case studies that dispel many of the myths about heterosexuality. Download your copy today!

And don‘t miss our companion report, How To Write An Anti-Gay Tract In Fifteen Easy Steps.

Anti-gay activists often charge that gay men and women pose a threat to children. In this report, we explore the supposed connection between homosexuality and child sexual abuse, the conclusions reached by the most knowledgeable professionals in the field, and how anti-gay activists continue to ignore their findings. This has tremendous consequences, not just for gay men and women, but more importantly for the safety of all our children.

Anti-gay activists often charge that gay men and women pose a threat to children. In this report, we explore the supposed connection between homosexuality and child sexual abuse, the conclusions reached by the most knowledgeable professionals in the field, and how anti-gay activists continue to ignore their findings. This has tremendous consequences, not just for gay men and women, but more importantly for the safety of all our children.

Anti-gay activists often cite the “Dutch Study” to claim that gay unions last only about 1½ years and that the these men have an average of eight additional partners per year outside of their steady relationship. In this report, we will take you step by step into the study to see whether the claims are true.

Tony Perkins’ Family Research Council submitted an Amicus Brief to the Maryland Court of Appeals as that court prepared to consider the issue of gay marriage. We examine just one small section of that brief to reveal the junk science and fraudulent claims of the Family “Research” Council.

The FBI’s annual Hate Crime Statistics aren’t as complete as they ought to be, and their report for 2004 was no exception. In fact, their most recent report has quite a few glaring holes. Holes big enough for Daniel Fetty to fall through.

The FBI’s annual Hate Crime Statistics aren’t as complete as they ought to be, and their report for 2004 was no exception. In fact, their most recent report has quite a few glaring holes. Holes big enough for Daniel Fetty to fall through.

Rob in San Diego

April 7th, 2011

GOD bless America! Thanks congress!

Curt

April 8th, 2011

My partner and I are a couple; married in California and living in community property state Washington. The IRS ruling helps us and I am extremely grateful that the IRS recognizes gay and lesbian couples. It is an important step to see the feds recognize gay relationships.

Leave A Comment