Box Turtle Bulletin

News and commentary about the anti-gay lobby

News and commentary about the anti-gay lobby News and commentary about the anti-gay lobby

News and commentary about the anti-gay lobbyAugust 30th, 2013

Two months after the U.S. Supreme Court declared Section 3 of the Defense of Marriage Act unconstitutional, the Treasury Department has ruled that same-sex married couples will be treated just like all married couples when they file their tax returns, regardless of whether they currently live in a state that recognizes same-sex marriage. That’s the good news for many and bad news for those whose combined incomes when filed as married pushes them into a higher tax bracket. Those are the breaks.

But the good news for everyone is that the Treasury Department’s determination on how same-sex couples will be treated on taxes means that they will be treated as married couples with federal estate and gift taxes, and the tax breaks that married couples get when a spouse is covered under an employer-provided health plan. Until now, the cost of those benefits was seen as extra income that was taxed at the full rate.

The ruling does not apply to couples who have domestic partnerships, civil unions, or other non-marriage arrangements. Married couples have the option of filing an amended return to claim refunds for tax years 2010 through 2012.

For married couples in states which do not recognize same-sex marriage, life can become interesting when they go to file the state income taxes this year. Before yesterday’s ruling, couples in, say, Massachusetts had to fill out their Federal forms twice: once as single individual for Federal tax purposes, and again as a married couple to figure out what their correct (and lower) Massachusetts state income tax would be. That’s because most state governments peg their state taxes according to what you paid at the federal level. But now that what married couples will be paying a different rate at the federal level, it’s unclear what the 37 states which do not recognize same-sex marriage will require their residents to do:

“I expect what will happen is that Ohio will say you have to file as single, and that they will do that based on the constitutional amendment,” (Lambda Legal director John) Davidson said. Santa Clara University Law professor Patricia Cain agreed, telling BuzzFeed states like Ohio with such amendments will have to “change their state income tax reporting rules to unhook them from federal reporting.”

Looking at a pending case in which a federal judge in Ohio has questioned Ohio’s failure to recognize the marriage of a same-sex couple, Jim Obergefell and John Arthur, who married in another state, however, Davidson also said, “But, as the Obergefell decision suggests, this is just going to prompt more litigation.”

Davidson pointed out that, in addition to Ohio, there are federal lawsuits by same-sex couples seeking marriage recognition pending in federal courts in Arkansas, Kentucky, Louisiana, Nevada, North Carolina, Oklahoma, Pennsylvania, South Carolina, Utah and Virginia and state lawsuits pending in Arkansas, Kentucky, Illinois, New Jersey, New Mexico and Texas.

Latest Posts

Featured Reports

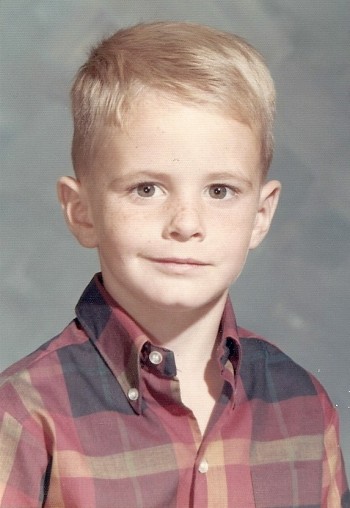

In this original BTB Investigation, we unveil the tragic story of Kirk Murphy, a four-year-old boy who was treated for “cross-gender disturbance” in 1970 by a young grad student by the name of George Rekers. This story is a stark reminder that there are severe and damaging consequences when therapists try to ensure that boys will be boys.

In this original BTB Investigation, we unveil the tragic story of Kirk Murphy, a four-year-old boy who was treated for “cross-gender disturbance” in 1970 by a young grad student by the name of George Rekers. This story is a stark reminder that there are severe and damaging consequences when therapists try to ensure that boys will be boys.

When we first reported on three American anti-gay activists traveling to Kampala for a three-day conference, we had no idea that it would be the first report of a long string of events leading to a proposal to institute the death penalty for LGBT people. But that is exactly what happened. In this report, we review our collection of more than 500 posts to tell the story of one nation’s embrace of hatred toward gay people. This report will be updated continuously as events continue to unfold. Check here for the latest updates.

In 2005, the Southern Poverty Law Center wrote that “[Paul] Cameron’s ‘science’ echoes Nazi Germany.” What the SPLC didn”t know was Cameron doesn’t just “echo” Nazi Germany. He quoted extensively from one of the Final Solution’s architects. This puts his fascination with quarantines, mandatory tattoos, and extermination being a “plausible idea” in a whole new and deeply disturbing light.

On February 10, I attended an all-day “Love Won Out” ex-gay conference in Phoenix, put on by Focus on the Family and Exodus International. In this series of reports, I talk about what I learned there: the people who go to these conferences, the things that they hear, and what this all means for them, their families and for the rest of us.

Prologue: Why I Went To “Love Won Out”

Part 1: What’s Love Got To Do With It?

Part 2: Parents Struggle With “No Exceptions”

Part 3: A Whole New Dialect

Part 4: It Depends On How The Meaning of the Word "Change" Changes

Part 5: A Candid Explanation For "Change"

At last, the truth can now be told.

At last, the truth can now be told.

Using the same research methods employed by most anti-gay political pressure groups, we examine the statistics and the case studies that dispel many of the myths about heterosexuality. Download your copy today!

And don‘t miss our companion report, How To Write An Anti-Gay Tract In Fifteen Easy Steps.

Anti-gay activists often charge that gay men and women pose a threat to children. In this report, we explore the supposed connection between homosexuality and child sexual abuse, the conclusions reached by the most knowledgeable professionals in the field, and how anti-gay activists continue to ignore their findings. This has tremendous consequences, not just for gay men and women, but more importantly for the safety of all our children.

Anti-gay activists often charge that gay men and women pose a threat to children. In this report, we explore the supposed connection between homosexuality and child sexual abuse, the conclusions reached by the most knowledgeable professionals in the field, and how anti-gay activists continue to ignore their findings. This has tremendous consequences, not just for gay men and women, but more importantly for the safety of all our children.

Anti-gay activists often cite the “Dutch Study” to claim that gay unions last only about 1½ years and that the these men have an average of eight additional partners per year outside of their steady relationship. In this report, we will take you step by step into the study to see whether the claims are true.

Tony Perkins’ Family Research Council submitted an Amicus Brief to the Maryland Court of Appeals as that court prepared to consider the issue of gay marriage. We examine just one small section of that brief to reveal the junk science and fraudulent claims of the Family “Research” Council.

The FBI’s annual Hate Crime Statistics aren’t as complete as they ought to be, and their report for 2004 was no exception. In fact, their most recent report has quite a few glaring holes. Holes big enough for Daniel Fetty to fall through.

The FBI’s annual Hate Crime Statistics aren’t as complete as they ought to be, and their report for 2004 was no exception. In fact, their most recent report has quite a few glaring holes. Holes big enough for Daniel Fetty to fall through.

Timothy Kincaid

August 30th, 2013

Very very few spouses face the mythical “marriage penalty”. While there are a few unique sets of circumstances in which there is such a penalty, in most instances the tax paid as a couple will be the same or less than the amount that the two individuals would have paid.

Paul Douglas

August 30th, 2013

We’ve been losing out on about $2000 a year because we haven’t been able to file jointly for the Feds. That’s history now.

Thank you President Obama. Had any republicon been in office, this would not have been allowed to happen. Anybody think Bush or McCain or Romnesia would have permitted the IRS under their watch to be so generous in interpreting the Supreme Court ruling?

Bose in St. Peter MN

August 30th, 2013

Yeah, it’s always been quicker & easier to abbreviate benefits, responsibilities and rights to just “benefits”.

Tax obligations from joint returns fall to both people, as well. No such thing as paying your half and letting the IRS go after the spouse for his/her portion… you’re both fully on the hook.

Divorce and community property fall in that area, too. Being married means being united as a single economic unit shared by both people (with some tweaks available by pre-nup).

Failing to complete a divorce after a break-up gets messy and complicated. Bankruptcy of one spouse but not the other is no picnic. Widow(er)s inherit any debts incurred by their spouse during the marriage in many/most states.

And that whole package is what we’ve been fighting for.

TomTallis

August 30th, 2013

We’ve gone throught the opposite here in California for the past five years: filing indivually for the feds and filing jointly for the state.

Now that we’ve finished the green card application, we’re starting on refiling the last couple of years of federal tax returns.

Rob

August 30th, 2013

I find the fact that we can amend federal returns to be good news. I’m disabled and my husband lost out on a lot of tax credits when he was making a pretty hefty salary, it would be nice to recoup that now that we are not as financially secure. I’ve been waiting for that news since they announced the ruling.

But not mentioned is that it also affects aids care and extra help for poorer individuals, we aren’t eligible for some treatment help and health services anymore because of this ruling. It shifts you into a higher bracket in other ways than just taxes.

We’ve had to miss medication due to the cuts, not sure what we do now. But I’d have married him anyway, if we knew then. It isn’t about the money, never was.

rewindrw

August 30th, 2013

It’s not a marriage penalty. It’s an investment in all those rights we’ve been fighting for. Those rights are worth far more than any increase any married pair of taxpayers experiences over single taxpayers.

We should stop calling it a penalty.

Timothy Kincaid

August 30th, 2013

Rob, congratulations. I hope you are able to recover a healthy sum.

If he was the sole earner, and if he filed reporting his total income as “single”, by amending to “married” he should have significant recovery.

HOWEVER, that being said, in California for the past several years same-sex couples could take advantage of the state’s community property laws and divide the joint income by two and each file federal returns for half (while there are some complexities, this is mostly true). So if you both were filing returns over the past several years with a competent accountant, you may already have been taxed in a lower tax bracket and your savings might not be worth the cost of amending.

So, before you amend your returns, if you live in California, PLEASE speak to your tax accountant before you amend your returns.

Kevin

August 30th, 2013

It sucks for people in NJ,Illinois etc that have civil unions or domestic partnerships but does provide more ammo in shooting down the stupid theory that seperate but equal is.

Stephen

August 31st, 2013

Like Rob, we had very unequal incomes over the past 4 or 5 years. We’d created something together from which we both did well but after 2009 much more of the income came to me. We didn’t bother filing joint returns in NY State because it seemed it would cost more to do than just to carry on being single. I’ll talk to my accountant about making emendations to past returns. My guess is that we could do quite well.

I don’t really care about higher brackets and so on. To me it’s worth knowing that I have legal standing. We live in a big farmhouse in a unique situation in Ulster County NY. Over the years we’ve restored and updated it. Some years ago we decided to put the house in my name with my now husband retaining a life interest. Which meant that we were gambling that he’d die before me and my tax burden would be diminished. Now we don’t need to worry about that. Not that the house is hugely valuable but it has no mortgage and does represent a sizable chunk of whatever assets we’ve managed to claw together. I’ve always thought that the marriage equality fight was about rights AND responsibilities. But then, I’ve always reckoned that his debts are mine and vice versa.

Rob

August 31st, 2013

Timothy- we have been in California and filed separately. And we filed married separate in the state, but I’m unsur how anyone could have filed federal returns as a married same sex couple as you infer(isn’t that what splitting the incomes would be doing, as that’s what married couples do, and the Feds didn’t see us as married) , so no, we didn’t do that. I’m on social security and filed my taxes myself, he used a service, but no we did not get advised to do what you say. But for at least one year he was an independent contractor and as such paid about 50 percent of his income I taxes…we will look for an accountant here in Palm Springs in the near future.

Jay

August 31st, 2013

My husband and I married this year. We live in a state that does not recognize same-sex marriage.

Does anyone know whether there would be an advantage in filing federal taxes as married but filing separately as opposed to married filing jointly?

Our state is one that figures the state tax liability on the basis of the federal tax liability. Will that have any consequences for how we should file at the federal level?

Timothy Kincaid

August 31st, 2013

Rob,

I’m unsur how anyone could have filed federal returns as a married same sex couple as you infer(isn’t that what splitting the incomes would be doing, as that’s what married couples do, and the Feds didn’t see us as married) , so no, we didn’t do that.

Actually, no, you wouldn’t have filed federally as married. You would have filed single, but each recorded on your own return your share of the community property income. It’s a strange little quirk and probably would not be known other than by an accountant who had some experience with domestic partners.

The good news is that you will now likely get a sizable recovery by amending your prior returns. When you look for an accountant, be sure to ask if they have experience with same-sex couples (but, being in Palm Springs, that may be unnecessary).

Timothy Kincaid

August 31st, 2013

Jay,

If one of you makes more than the other, you will likely pay less taxes by filing as married. And there is also the matter of law; if you were legally married in a state that allows for marriage, then you are required to file federally as married.

As to your state taxes, no one probably even knows at this time how that will be handled. It is likely that someone in your state (perhaps the revenue agency or the attorney general or maybe even the state court) will make a ruling.

Jay

September 1st, 2013

Thanks, Timothy. I should have specified that we married in Massachusetts, but live in a southern state that does not recognize our marriage.

I know that we have to file our federal taxes as married. My question has to do with whether the difference between filing jointly or filing separately. As I understand it, married couples are given the option of filing jointly or filing separately. But I don’t know under what circumstances it is beneficial for married couples to file separately or jointly.

The other question is one that I guess no one knows now. Our state simply uses the federal numbers to assess our state income taxes. If we file jointly, will we in effect force our state to recognize our marriage? Or would be forced to file separately in order to allow the state not to recognize our marriage?

As I said, the latter question may not be answerable at this time. But it occurs to me that this could be a way to force states that rely on the federal numbers to recognize, at least for income tax purposes, same-sex marriages.

Leave A Comment