Box Turtle Bulletin

News and commentary about the anti-gay lobby

News and commentary about the anti-gay lobby News and commentary about the anti-gay lobby

News and commentary about the anti-gay lobbyAugust 25th, 2007

Last Thursday, BTB’s Daniel Gonzales told you about Ted Haggard’s fundraising letter, where he asked his supporters to help defray his living expenses as he takes up residence at a halfway house for ex-cons, recovering alcoholics, drug addicts, prostitutes, and “other broken people.”

Last Thursday, BTB’s Daniel Gonzales told you about Ted Haggard’s fundraising letter, where he asked his supporters to help defray his living expenses as he takes up residence at a halfway house for ex-cons, recovering alcoholics, drug addicts, prostitutes, and “other broken people.”

According to Haggard’s letter, concerned supports can send their donations directly to the Haggard family in Phoenix. But if anyone needs a tax deduction, they can instead send a check to a Colorado Springs-based charity called “Families With A Mission,” who will then forward those funds to the Haggard family — minus ten percent for “administrative costs.”

As BTB’s Timothy Kincaid pointed out, “[I]f a non-profit is receiving funds which Haggard solicits to be used for his personal benefit and then providing a tax deduction, that would be tax fraud.”

It looks like tax fraud is just the beginning. Dan Savage of Seattle’s The Stranger did some digging and found some rather interesting information about Families With A Mission. The first problem is that the only “Families with a Mission” group registered with the Colorado Secretary of State — using the same mailing address as in Haggard’s fundraising letter — was dissolved last February.

A defrocked preacher being complicit in tax fraud with a non-existent organization. Can it possibly get any worse than that?

Well, yes. It turns out that the only name associated with the now-dissolved charity is a guy by the name of Paul Huberty, a registered sex offender with the state of Hawaii.

Court records in Hawaii show that Paul G. Huberty was found guilty of attempted sexual assault in January of 2004 (download ’em here, here, and here), and sentenced a year in jail with all but six months suspended. Huberty was also put on probation for five years, ordered to take polygraphs, not allowed to possess pornography, “not allowed on the property of Kona Christian Academy” and other schools, not allowed to posses firearms, forbidden from foster parenting or being the guardian of a minor, and ordered to pay restitution to a crime victims fund.

It looks like Pastor Ted’s becoming “completely heterosexual” hasn’t done much to improve his sense of judgment.

Latest Posts

Featured Reports

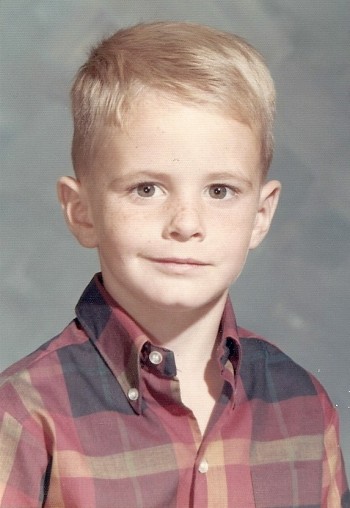

In this original BTB Investigation, we unveil the tragic story of Kirk Murphy, a four-year-old boy who was treated for “cross-gender disturbance” in 1970 by a young grad student by the name of George Rekers. This story is a stark reminder that there are severe and damaging consequences when therapists try to ensure that boys will be boys.

In this original BTB Investigation, we unveil the tragic story of Kirk Murphy, a four-year-old boy who was treated for “cross-gender disturbance” in 1970 by a young grad student by the name of George Rekers. This story is a stark reminder that there are severe and damaging consequences when therapists try to ensure that boys will be boys.

When we first reported on three American anti-gay activists traveling to Kampala for a three-day conference, we had no idea that it would be the first report of a long string of events leading to a proposal to institute the death penalty for LGBT people. But that is exactly what happened. In this report, we review our collection of more than 500 posts to tell the story of one nation’s embrace of hatred toward gay people. This report will be updated continuously as events continue to unfold. Check here for the latest updates.

In 2005, the Southern Poverty Law Center wrote that “[Paul] Cameron’s ‘science’ echoes Nazi Germany.” What the SPLC didn”t know was Cameron doesn’t just “echo” Nazi Germany. He quoted extensively from one of the Final Solution’s architects. This puts his fascination with quarantines, mandatory tattoos, and extermination being a “plausible idea” in a whole new and deeply disturbing light.

On February 10, I attended an all-day “Love Won Out” ex-gay conference in Phoenix, put on by Focus on the Family and Exodus International. In this series of reports, I talk about what I learned there: the people who go to these conferences, the things that they hear, and what this all means for them, their families and for the rest of us.

Prologue: Why I Went To “Love Won Out”

Part 1: What’s Love Got To Do With It?

Part 2: Parents Struggle With “No Exceptions”

Part 3: A Whole New Dialect

Part 4: It Depends On How The Meaning of the Word "Change" Changes

Part 5: A Candid Explanation For "Change"

At last, the truth can now be told.

At last, the truth can now be told.

Using the same research methods employed by most anti-gay political pressure groups, we examine the statistics and the case studies that dispel many of the myths about heterosexuality. Download your copy today!

And don‘t miss our companion report, How To Write An Anti-Gay Tract In Fifteen Easy Steps.

Anti-gay activists often charge that gay men and women pose a threat to children. In this report, we explore the supposed connection between homosexuality and child sexual abuse, the conclusions reached by the most knowledgeable professionals in the field, and how anti-gay activists continue to ignore their findings. This has tremendous consequences, not just for gay men and women, but more importantly for the safety of all our children.

Anti-gay activists often charge that gay men and women pose a threat to children. In this report, we explore the supposed connection between homosexuality and child sexual abuse, the conclusions reached by the most knowledgeable professionals in the field, and how anti-gay activists continue to ignore their findings. This has tremendous consequences, not just for gay men and women, but more importantly for the safety of all our children.

Anti-gay activists often cite the “Dutch Study” to claim that gay unions last only about 1½ years and that the these men have an average of eight additional partners per year outside of their steady relationship. In this report, we will take you step by step into the study to see whether the claims are true.

Tony Perkins’ Family Research Council submitted an Amicus Brief to the Maryland Court of Appeals as that court prepared to consider the issue of gay marriage. We examine just one small section of that brief to reveal the junk science and fraudulent claims of the Family “Research” Council.

The FBI’s annual Hate Crime Statistics aren’t as complete as they ought to be, and their report for 2004 was no exception. In fact, their most recent report has quite a few glaring holes. Holes big enough for Daniel Fetty to fall through.

The FBI’s annual Hate Crime Statistics aren’t as complete as they ought to be, and their report for 2004 was no exception. In fact, their most recent report has quite a few glaring holes. Holes big enough for Daniel Fetty to fall through.

Robguy

August 25th, 2007

Not allowed to possess porn? Cruel and unusual! ;)

Timothy Kincaid

August 25th, 2007

One small caution: although the Colorado Secretary of State shows the charity as “volunarily dissolved”, that may not be exactly as it seems.

I’m guessing here (but an educated guess) that failure to file can lead to “voluntary dissolution”, a technical glitch that can be fixed by filing delinquent reports. Of course, it may also indicate that they decided to pack it all up.

In any case, I believe that a charity that is not actively recognized cannot offer tax deductible contribution status. I do hope that those who give to Ted Haggard in this way do not jeopardize their own standing with the IRS by deducting such contibutions on their Schedule A. I’m sure, good Christians that they are, they’d be horrified to discover they were complicit in tax fraud. And even more horrified at the penaties they could incur for doing so.

Samantha Davis

August 25th, 2007

Well, that would certainly explain a lot for why I wasn’t able to find their website when I googled them yesterday.

AM

August 25th, 2007

Bit confused here…(Glad I majored in something easy like Chemistry, not Accounting.)

At any rate, is the issue the “mix” of contributions, i.e. — direct personal checks and non-profit disbursements?

My thought is that a person sending a check to the Billy Graham Association, for example, would possibly be contributing to Mr. Graham’s salary — albeit non-profits *do* have salary caps? Of course, the majority of the money would assumedly go for literature, daily operating expenses, etc…

My recollection of some ministries will say, “Do not put my name anywhere on the check”, so I am guessing that would invalidate the non-profit tax code status, the earmarking, so to speak?

Admittedly, it sounds wonky, the idea of double dipping, but I just was curious about clarification — inquiring minds want to know.

Timothy Kincaid

August 27th, 2007

AM,

It all goes to the purpose of the charity. A ministry such as the Billy Graham Evangelical Association can pay Dr. Graham a salary for the work he does towards the BGEA’s stated goals.

And, indeed, there are charities that pay expenses for people in need (think hurricane victims).

But paying the daily expenses of the Haggard family is not likely to be a charitable purpose approved by the IRS. And providing deductions for a purpose other than that which is approved is tax fraud.

AM

August 27th, 2007

Hey Timothy,

I don’t know what constitutes daily expenses versus a capped salary on paper — but I think I understand where you are going with this.

To be honest with you, what bothers me more is the over a half million dollar home that is sitting around that could be sold and used for living expenses.

When this first came out, I thought snarkily, “Wow, to be able to sin and then have others support you financially for two years!”

As a Christian, I do believe adultery (of any kind) is sin. I also see precedence — think David and Bathsheba — in which individuals don’t necessarily get off scot-free — even in the age of grace.

So, selling a pricey home and living off of the proceeds — hmmm…seems reasonable and sensible not to mention thoughtful and right to me.

But, hey, what do I know? ;-)

Timothy Kincaid

August 28th, 2007

To the best of my knowledge, there is not any property in the name of Ted Haggard or his wife. He may not actually own the house.

Samantha Davis

August 29th, 2007

Well, being a layperson my analysis might be a bit wrong but if charities are allowed to give to poor people in need and if Ted Haggard has kept all of his belongings in the possession of his organization might that make him a “poor person” and thus able to recieve charitable donations?

Someone please clarify, I’m not an accountant or a tax lawyer.

Timothy Kincaid

August 31st, 2007

A clarification – Haggard does indeed own his house in Colorado. However, he may not have much equity in this house.

Samantha,

If you are hungry a charity can feed you. If you need clothing it can cloth you. What it cannot do is simply provide unlimited funds solicited to the public and channelled to you through a charity.

If you want more information or seek a deeper understanding, the tax code is available online.

http://www.irs.gov/charities/charitable/index.html

Leave A Comment