Box Turtle Bulletin

News and commentary about the anti-gay lobby

News and commentary about the anti-gay lobby News and commentary about the anti-gay lobby

News and commentary about the anti-gay lobbyMarch 26th, 2008

Hey gay couples, grab your checkbooks. It’s that time of year where you get to pay more than your brother and his wife.

Hey gay couples, grab your checkbooks. It’s that time of year where you get to pay more than your brother and his wife.

If you are part of a couple, you usually would benefit from filing an income tax return as a married couple. While this is not always the case, it is especially true for those couples in which one of the partners has a much lower income than the other.

Some states have decided that they value their gay citizens and seek to encourage stable families and have changed their laws so as to treat gay couples the same as heterosexual couples in their tax law. Massachusetts, California, Vermont, and Connecticut all allow for couples to file joint tax returns (this may also be the case in New Jersey, New Hampshire, Maine, Washington and Oregon and perhaps for some Rhode Island and New York residents – I haven’t researched every state).

But while this is to be commended and advanced in more states, it isn’t as simple as it seems. The federal government doesn’t care what the states have determined, they only recognize marriage as between a man and a woman. Thus, gay couples get to jump through hoops and make multiple tax returns. This becomes costly whenever you have a complicated return.

For example, a California couple in a Domestic Partnership has to prepare its state return as though they were a married couple. But CA tax law relies on federal tax treatment of certain situations, so this couple often has to prepare a federal income tax return as a married couple in order to apply the appropriate treatment on their state returns.

But they can’t file that federal joint return. The IRS won’t accept it. Instead they have to prepare federal returns as though they were unrelated roommates.

Add in some complexity, such as multiple state returns, and you may end up paying your accountant a much higher rate due to the extra time they incur.

If you can. Some accountants may not be familiar with the procedures at all.

H&R Block, the nation’s largest tax firm, is being sued by the ACLU because their online do-it-yourself system can’t accomodate Connecticut’s civil unions. Connecticut gay couples have to pay about $150 more and go into the H&R Block office in order to get their returns prepared correctly.

So the next time you hear some anti-gay whine about “special rights”, remind them that you pay more for your government than they do.

UPDATE

Reader John brought to my attention one of the stupidest and cruelest inconsistencies.

If your brother receives insurance covering his wife, it’s a tax free benefit. If you receive insurance covering your same-sex spouse, the federal government considers that to be a taxable part of your income. Yes, they actually make you pay income taxes on the amount of health insurance that you receive from your company for your spouse if you are gay.

I guess that concern about Americans without health insurance extends only to heterosexuals.

Latest Posts

Featured Reports

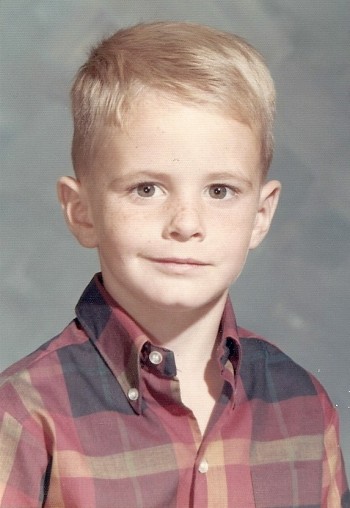

In this original BTB Investigation, we unveil the tragic story of Kirk Murphy, a four-year-old boy who was treated for “cross-gender disturbance” in 1970 by a young grad student by the name of George Rekers. This story is a stark reminder that there are severe and damaging consequences when therapists try to ensure that boys will be boys.

In this original BTB Investigation, we unveil the tragic story of Kirk Murphy, a four-year-old boy who was treated for “cross-gender disturbance” in 1970 by a young grad student by the name of George Rekers. This story is a stark reminder that there are severe and damaging consequences when therapists try to ensure that boys will be boys.

When we first reported on three American anti-gay activists traveling to Kampala for a three-day conference, we had no idea that it would be the first report of a long string of events leading to a proposal to institute the death penalty for LGBT people. But that is exactly what happened. In this report, we review our collection of more than 500 posts to tell the story of one nation’s embrace of hatred toward gay people. This report will be updated continuously as events continue to unfold. Check here for the latest updates.

In 2005, the Southern Poverty Law Center wrote that “[Paul] Cameron’s ‘science’ echoes Nazi Germany.” What the SPLC didn”t know was Cameron doesn’t just “echo” Nazi Germany. He quoted extensively from one of the Final Solution’s architects. This puts his fascination with quarantines, mandatory tattoos, and extermination being a “plausible idea” in a whole new and deeply disturbing light.

On February 10, I attended an all-day “Love Won Out” ex-gay conference in Phoenix, put on by Focus on the Family and Exodus International. In this series of reports, I talk about what I learned there: the people who go to these conferences, the things that they hear, and what this all means for them, their families and for the rest of us.

Prologue: Why I Went To “Love Won Out”

Part 1: What’s Love Got To Do With It?

Part 2: Parents Struggle With “No Exceptions”

Part 3: A Whole New Dialect

Part 4: It Depends On How The Meaning of the Word "Change" Changes

Part 5: A Candid Explanation For "Change"

At last, the truth can now be told.

At last, the truth can now be told.

Using the same research methods employed by most anti-gay political pressure groups, we examine the statistics and the case studies that dispel many of the myths about heterosexuality. Download your copy today!

And don‘t miss our companion report, How To Write An Anti-Gay Tract In Fifteen Easy Steps.

Anti-gay activists often charge that gay men and women pose a threat to children. In this report, we explore the supposed connection between homosexuality and child sexual abuse, the conclusions reached by the most knowledgeable professionals in the field, and how anti-gay activists continue to ignore their findings. This has tremendous consequences, not just for gay men and women, but more importantly for the safety of all our children.

Anti-gay activists often charge that gay men and women pose a threat to children. In this report, we explore the supposed connection between homosexuality and child sexual abuse, the conclusions reached by the most knowledgeable professionals in the field, and how anti-gay activists continue to ignore their findings. This has tremendous consequences, not just for gay men and women, but more importantly for the safety of all our children.

Anti-gay activists often cite the “Dutch Study” to claim that gay unions last only about 1½ years and that the these men have an average of eight additional partners per year outside of their steady relationship. In this report, we will take you step by step into the study to see whether the claims are true.

Tony Perkins’ Family Research Council submitted an Amicus Brief to the Maryland Court of Appeals as that court prepared to consider the issue of gay marriage. We examine just one small section of that brief to reveal the junk science and fraudulent claims of the Family “Research” Council.

The FBI’s annual Hate Crime Statistics aren’t as complete as they ought to be, and their report for 2004 was no exception. In fact, their most recent report has quite a few glaring holes. Holes big enough for Daniel Fetty to fall through.

The FBI’s annual Hate Crime Statistics aren’t as complete as they ought to be, and their report for 2004 was no exception. In fact, their most recent report has quite a few glaring holes. Holes big enough for Daniel Fetty to fall through.

John

March 26th, 2008

TurboTax specifically asked me whether I recieved Domestic Partner Benefits from my employer and explained that those are taxable. My partner and I file separately as single. I didn’t do anything prior to that to trigger the question, so they are asking this question to everyone using their product.

I was annoyed to be reminded that gay people have to pay taxes on benefits that married heterosexuals didn’t, but on the other hand, I thought it was a potential positive, in that other taxpayers were being educated to the unfair tax discrimination that gay Americans faced.

I doubt many Americans want the “special rights” of paying higher taxes than their neighbors.

Scott

March 27th, 2008

Yeah, there is clearly not equal treatment for gay couples. But, this isn’t necessarily a financial negative. My partner and I would pay more if we were married (I have done the calculations)! Even with paying higher income taxes as a married couple, the whole marriage package of rights and responsibilities of that legal arrangement would be worth it.

Leave A Comment