Box Turtle Bulletin

News and commentary about the anti-gay lobby

News and commentary about the anti-gay lobby News and commentary about the anti-gay lobby

News and commentary about the anti-gay lobbyAugust 30th, 2010

A chapter of the Exodus Global Alliance was denied “charitable status” by New Zealand’s Charities Commission, denying a local Christian Trust’s exemption from paying income taxes. Before this ruling, Exodus had enjoyed its tax-exempt status for about a decade.

Citing guidelines and policies among professional psychiatric, psychological and counseling organizations, the Charities Commision declared that Exodus was not performing a legitimate public benefit because homosexuality was not a mental disorder and did not need curing. The commission also noted the American Psychological Association’s report which found that there was little scientific evidence that homosexuality could be “cured.”

You can read the commission’s decision here (PDF: 809KB/15 pages)

Latest Posts

Featured Reports

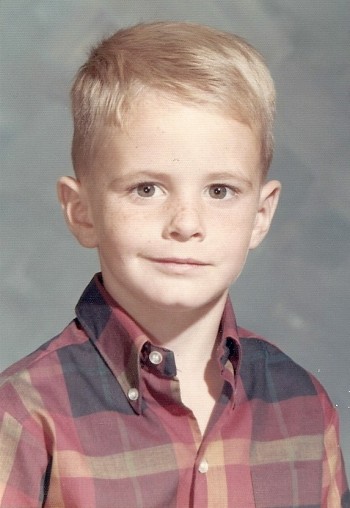

In this original BTB Investigation, we unveil the tragic story of Kirk Murphy, a four-year-old boy who was treated for “cross-gender disturbance” in 1970 by a young grad student by the name of George Rekers. This story is a stark reminder that there are severe and damaging consequences when therapists try to ensure that boys will be boys.

In this original BTB Investigation, we unveil the tragic story of Kirk Murphy, a four-year-old boy who was treated for “cross-gender disturbance” in 1970 by a young grad student by the name of George Rekers. This story is a stark reminder that there are severe and damaging consequences when therapists try to ensure that boys will be boys.

When we first reported on three American anti-gay activists traveling to Kampala for a three-day conference, we had no idea that it would be the first report of a long string of events leading to a proposal to institute the death penalty for LGBT people. But that is exactly what happened. In this report, we review our collection of more than 500 posts to tell the story of one nation’s embrace of hatred toward gay people. This report will be updated continuously as events continue to unfold. Check here for the latest updates.

In 2005, the Southern Poverty Law Center wrote that “[Paul] Cameron’s ‘science’ echoes Nazi Germany.” What the SPLC didn”t know was Cameron doesn’t just “echo” Nazi Germany. He quoted extensively from one of the Final Solution’s architects. This puts his fascination with quarantines, mandatory tattoos, and extermination being a “plausible idea” in a whole new and deeply disturbing light.

On February 10, I attended an all-day “Love Won Out” ex-gay conference in Phoenix, put on by Focus on the Family and Exodus International. In this series of reports, I talk about what I learned there: the people who go to these conferences, the things that they hear, and what this all means for them, their families and for the rest of us.

Prologue: Why I Went To “Love Won Out”

Part 1: What’s Love Got To Do With It?

Part 2: Parents Struggle With “No Exceptions”

Part 3: A Whole New Dialect

Part 4: It Depends On How The Meaning of the Word "Change" Changes

Part 5: A Candid Explanation For "Change"

At last, the truth can now be told.

At last, the truth can now be told.

Using the same research methods employed by most anti-gay political pressure groups, we examine the statistics and the case studies that dispel many of the myths about heterosexuality. Download your copy today!

And don‘t miss our companion report, How To Write An Anti-Gay Tract In Fifteen Easy Steps.

Anti-gay activists often charge that gay men and women pose a threat to children. In this report, we explore the supposed connection between homosexuality and child sexual abuse, the conclusions reached by the most knowledgeable professionals in the field, and how anti-gay activists continue to ignore their findings. This has tremendous consequences, not just for gay men and women, but more importantly for the safety of all our children.

Anti-gay activists often charge that gay men and women pose a threat to children. In this report, we explore the supposed connection between homosexuality and child sexual abuse, the conclusions reached by the most knowledgeable professionals in the field, and how anti-gay activists continue to ignore their findings. This has tremendous consequences, not just for gay men and women, but more importantly for the safety of all our children.

Anti-gay activists often cite the “Dutch Study” to claim that gay unions last only about 1½ years and that the these men have an average of eight additional partners per year outside of their steady relationship. In this report, we will take you step by step into the study to see whether the claims are true.

Tony Perkins’ Family Research Council submitted an Amicus Brief to the Maryland Court of Appeals as that court prepared to consider the issue of gay marriage. We examine just one small section of that brief to reveal the junk science and fraudulent claims of the Family “Research” Council.

The FBI’s annual Hate Crime Statistics aren’t as complete as they ought to be, and their report for 2004 was no exception. In fact, their most recent report has quite a few glaring holes. Holes big enough for Daniel Fetty to fall through.

The FBI’s annual Hate Crime Statistics aren’t as complete as they ought to be, and their report for 2004 was no exception. In fact, their most recent report has quite a few glaring holes. Holes big enough for Daniel Fetty to fall through.

Lindoro Almaviva

August 30th, 2010

OUCH!

Regan DuCasse

August 30th, 2010

They are NOT a charitable organization. Far from it. And I’m glad that the folks in NZ who are in charge of those things see Exodus for what they are.

It’s about time, and I wish people in the US would follow this same example.

Patrick

August 30th, 2010

Brilliant!

Good on ya Kiwis.

John

August 30th, 2010

Different country, different rules. If this happened here in the States, however, I would find this to be a disturbing violation of the First Amendment even though I very much oppose Exodus. Of course, this would depend upon how they are claiming tax-exempt status. If its as a non-prof religious organization, they meet those standards, ditto for a non-prof issue group.

anteros

August 30th, 2010

i thought charities depend on donations to offer free services of a noble nature. has exodus ever offered free services? i always thought of it as a business, with a religious element… it’s not a church, right? considering the revelations shared by many ex-gay survivors, it seems more like a money making scam than a regular business. i don’t see why it was given tax exempt status in the first place.

anteros

August 30th, 2010

i guess there are a number of tax exempt charities out there presenting noble causes to attract donations, but those donations don’t always serve the purpose intended by those giving donations… a bit like haiti.

anyways, exodus should be a proud tax payer… paying tax hurts, but it’s not a bad thing… it’s not like a fine or a penalty.

Emily K

August 30th, 2010

John, the first amendment does not cover a “right to tax exempt status.” Exodus still has every right to exist as an entity – as long as they pay taxes, like any other entity.

They are not a charity and they do not provide needed services to anybody.

John

August 30th, 2010

Emily: Of course not. Yet the government cannot discriminate on the basis of content of speech by Exodus or any other group. They have a right under the First Amendment to be as anti-gay in their message as their religious beliefs dictate. If Exodus fails to abide by the conditions of spending what it takes in or endorsing political candidates, that’s another matter entirely. Look, it would be very easy and emotionally satisfying in some ways to deny each and every group I disagree with tax exempt status but there are two problems with this:

1) Allowing me to show such favoritism not only would have a chilling effect on the First Amendment, but arguably the 14th Amendment as well, not to mention puts those groups I like in jeopardy once the political penduluum swings again and the other guys get in power. By defending their rights I’m protecting my own as well.

2) I strongly support tax exempt status for religious groups because I see it as a bulwark in defense of the First Amendment. This isn’t to say that it isn’t abused or perhaps needs some tightening, but I see nothing about Exodus that would make me agree with stripping it from them. Well, other than I dislike the group.

John in the Bay Area

August 30th, 2010

I think Exodus is essentially a political organization, rather than a religious organization. But I doubt the IRS would want to take that sort of an issue on. Hopefully they implode from lack of funding and an out of control mortgage.

Emily K

August 30th, 2010

As far as I could tell, NZ didn’t strike down Exodus’ tax exempt status because they didn’t like their message. They struck it down because one of the criteria, “providing a legitimate public benefit,” was not being met. No one’s free speech was encroached upon.

“Curing” people of something that is not a disease is not a public benefit.

Erin

August 30th, 2010

I agree with Emily. The government of NZ didn’t take away their right to operate, and any government should certainly look into how its money is being managed. Why support an organization with government tax breaks when it serves no useful purpose to the people of NZ and they have the ability to exist via donations from members anyway?

Timothy Kincaid

August 31st, 2010

John in the bay area,

In the US, “political” has a specific definition. It doesn’t matter to the IRS if Exodus is preaching Jesus or preaching capitalism, as long as they are not seeking to impact votes or legislation. And it doesn’t matter whether change therapy works or not, advocating for the bizarre or impossible is treated the same as a campaign to see your doctor for a mammogram.

John

August 31st, 2010

As I said: “different country, different rules”. I haven’t a clue how NZ treats free speech or religious freedom issues, let alone how ingrained these are as guaranteed rights in their society and culture. Do they have a written constitution like the US or unwritten like the UK? I assume the latter but have no idea. If NZ believes that Exodus violated their rules and therefore doesn’t deserve tax-exempt status, okay that’s for Exodus to take up with the Kiwis. I was speaking about if a similar action was taken here in the States.

Maurice Lacunza

August 31st, 2010

AMERICA SHOULD DENY TAX EXEMPT STATUS TO CHURCHES. If they can prove that they are not hate mongering nor political, then they could apply for a special tax exempt status.

Removing tax exempt status from churches would affect their power by affecting their money.

Publius

August 31st, 2010

I say, if it walks like a duck and quacks like a duck, it’s a duck.

Exodus is a political “charity”, pure and simple. And it does a disservice to the pubic. Calling yourself religious doesn’t make you religious, even in the US.

Publius

August 31st, 2010

Another point: If a tax-exempt church wants to operate a for-profit laundromat, said laundromat should be taxed like any other business that it competes with, regardless of the fact that the profits benefit a religious organization. Otherwise, said laundromat would have an unfair business advantage over its competitors.

If Exodus is purely religious and seeking to advance a religion, fine. However, if it wants to masquerade as a secular psychotherapeutic clinic, then it should be treated like any other secular psychotherapeutic clinic regardless of the fact that it is operated by a religious organization. And giving a tax-advantage to a bogus clinic that treats non-existent mental disease is an abuse of the tax code.

Maurice Lacunza

August 31st, 2010

As I understand it, a church can’t operate a for profit business and also enjoy tax free status for that business. I think America has that figured out.

But the real problem is that churches have immense power by the sheer volume of money that flows in. Money equals power. Too many churches, e.g., Mormons, Catholics, try to influence public policy based on tax exempt religious philosophy.

I think that if we take away their easy access to tax deductible donation money, then congregants will demand a higher accountability for non-deductible money that is given. We could watch them rediscover their roots in socialism and microorganization.

Timothy Kincaid

August 31st, 2010

It is.

I think that there is a very large misunderstanding of how non-profit organizations interact with the tax code. I read comments like this all the time.

Timothy Kincaid

August 31st, 2010

maurice,

Are you equally willing to take away the tax status of the Human Rights Campaign? Or of AIDS Project Los Angeles?

Let’s be sure that our objections to tax policy are not based in who we like or do not like.

Emily K

August 31st, 2010

I know very little about the tax code here and nothing about it in NZ. But in my view, the NZ gov did not strip Exodus of the tax exempt status because they didn’t like their message. They did it because of a technicality. An analogous situation here I suppose would be if Exodus decided to start making a profit from a section of their organization but disguised it to cheat the tax code. It would be a technical situation. I believe the situation in NZ was a technical one, not even a political one.

John in the Bay Area

August 31st, 2010

Timothy,

I no longer contribute to HRC, largely because I felt they were more interested in protecting the Obama Administration than protecting gay and lesbian Americans.

However, when I did contribute, since I knew they were a political lobbying organization, I never treated any donations as tax-deductible. Perhaps I just don’t understand what is and isn’t deductible, but I really think that a donations to a political lobbying group like HRC or Exodus (which has done a great deal of lobbying around various pieces of legislation) should not be tax deductible.

I would like to see the rules around tax exempt organizations contributing or lobbying for or against propositions tightened, including the priest or whoever on the altar telling the parishoners to vote for or against this or that particular proposition on the ballot. I’d like to see these groups lose their tax exempt status for these sorts of actions.

Timothy Kincaid

August 31st, 2010

John iba,

Bad example on my part. Duh!

The rules are pretty simple and are up to the organization to follow. To receive tax deductible contributions they can only do an insignificant amount of lobbying for a bill or politician. Thus a church can preach every Sunday about abortion, but needs to tread carefully when there is actual proposed legislation.

But orgs can attempt to sway public opinion on issues, ideas, concepts, positions, as long as they aren’t directed towards actual legislation. Exodus does this stuff, and very very seldom weighs in on bills or propositions.

werdna

September 1st, 2010

Timothy wrote: “To receive tax deductible contributions they can only do an insignificant amount of lobbying for a bill or politician.”

This is not quite right. It’s true that churches and religious organizations can do a certain amount of lobbying for legislation (including ballot initiatives), so long as it is not a “a substantial part of its overall activities”. The IRS is quite clear, however, that such groups “are absolutely prohibited from directly or indirectly participating in, or intervening in, any political campaign on behalf of (or in opposition to) any candidate for elective public office.”

John

September 1st, 2010

Are you certain you want to give government bureaucrats and politicians this kind of power to determine whether a group is “hate mongering nor political”? We have a First Amendment for a very good reason and such a move as this would eviscerate it as partisans from all sides would jump in to silence their foes. Saying that tax-exempt status has nothing to do with free speech is naive IMO because such an unequal use of government power has a very chilling effect on speech and is not a game we want to play lest OUR side face the same when our foes are in power.

toujoursdan

September 1st, 2010

Do they have a written constitution like the US or unwritten like the UK?

New Zealand has a number of documents adopted over its century of independence that is referred to as their Constitution. In 1990 they adopted a Bill of Rights which guarantees:

13 Freedom of thought, conscience, and religion

* Everyone has the right to freedom of thought, conscience, religion, and belief, including the right to adopt and to hold opinions without interference.

14 Freedom of expression

* Everyone has the right to freedom of expression, including the freedom to seek, receive, and impart information and opinions of any kind in any form.

15 Manifestation of religion and belief

* Every person has the right to manifest that person’s religion or belief in worship, observance, practice, or teaching, either individually or in community with others, and either in public or in private.

Timothy Kincaid

September 1st, 2010

werda,

quite right. thanks for the correction.

Maurice Lacunza

September 2nd, 2010

Timothy,

I understand that the blade swings both ways; HRC and others could potentially be affected by tighter tax codes.

My point though is that agencies such as Focus on the Family and God Hates Fags are no different than the Ku Klux Klan. If the activities of a group promote discrimination against women, race, skin color, sexual orientation, or handicap, then such groups ought not enjoy the benefit of tax free donations.

Many people will still donate money, but, it will be collectively less and I am guessing that a higher accountability will be demanded for how that money is spent.

It’s a tough one to sort out. For me, I would take the stand that if a group promotes discrimination, then they lose their tax exempt status.

Timothy Kincaid

September 2nd, 2010

Maurice,

I completely and entirely support the right of the KKK to be treated like any other organization. I adamantly oppose any effort to use the tax code to reward or punish organizations based on the political or other ideology of its participants.

Inequality has a nasty habit of biting those who support it on the ass.

John in the Bay Area

September 2nd, 2010

Timothy,

I don’t know how active the KKK is now, if at all. However, the US does punish groups, perhaps indirectly for their politics and ideology, under the Patriot Act. Donations to a terrorist organization (or the humanitarian arm of such organizations-like Hamas linked charities that provide food and medical care to Palestinians) will result in your tax deduction being denied and possibly facing charges for providing material support to a terrorist organization. The KKK has been one of the most active terrorist groups in the US. The number of Americans lynched or otherwise murdered or terrorized by the group is enormous.

So, I think that a case can be made that contributions to the KKK shouldn’t be tax deductible, and anyone making such donations should be investigated for providing material support to a terrorist organization.

Perhaps another not so great example.

Leave A Comment